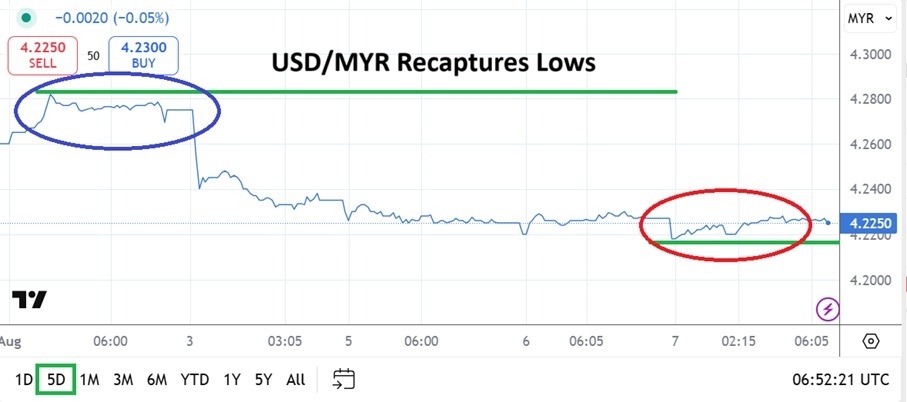

The past handful of days has seen the USD/MYR recapture its lower price terrain, this after a correlated run higher led to highs of nearly 4.2800 last Friday. The USD/MYR is now around 4.2250.

The USD/MYR has delivered once again for speculators who pursue the currency pair and believe in its ability to correlate with the broad Forex market. In trading today the 4.2250 ratio is being demonstrated, taking into regard its rather wide spread and lack of huge volume. The USD/MYR moved higher from about the 24th of July up until last Friday when a high around the 4.2800 was challenged.

Then after U.S jobs numbers were released, and after the USD/MYR was opened again for trading early on Monday, the currency pair produced solid lower price action and tested depths near 4.2300. The USD/MYR has the ability to move fast. Speculators who wager on the USD/MYR via their broker’s platforms need to make sure they understand that price velocity can sometimes be rapid.

Correlations with Broad Forex Market

The ability of the USD/MYR to recapture its lower terrain it attractive and tempting for traders. The current value of 4.2250 certainly is within the lowest part of its weekly technical chart, but it is also hovering near mid-term support levels which have seemingly used the 4.2000 ratio as target practice via financial institutions.

Malaysia has been able to stay out of the tariff spectacle via Washington D.C and this has created calm in the USD/MYR. But more importantly the ability to move higher the last week of July and through Wednesday of last week showed the correlation the USD/MYR has with broad market sentiment. Financial institutions globally were nervous about the U.S Federal Reserve and its proclaiming ‘uncertainty’ about interest rates.

Top Regulated Brokers

Turnaround Back to Lower Depths and Wagers

However, when the weaker U.S jobs numbers came out late last week this certainly sparked selling of the USD widely and the USD/MYR was part of this show. Financial institutions now believe the Fed will have to cut interest rates again in September, and because of this the USD/MYR is bouncing up against its lower values.

- The 4.2200 may be a target for some speculators, but they need to use take profit orders to make sure they are filled on their wagers.

- Day traders need to understand betting on the USD/MYR is difficult because of limited volumes, there is potential for sharp reversals in the currency pair that sometimes can only be managed by entry price orders with sharp numbers.

- Looking for additional downside in the USD/MYR after its recent move lower should be done with caution.

- The USD/MYR may test additional lows, but it also has the capability of moving slightly higher with intraday reversals which can harm day traders.

USD/MYR Short Term Outlook:

Current Resistance: 4.2290

Current Support: 4.2210

High Target: 4.2390

Low Target: 4.2150

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Malaysia to check out.