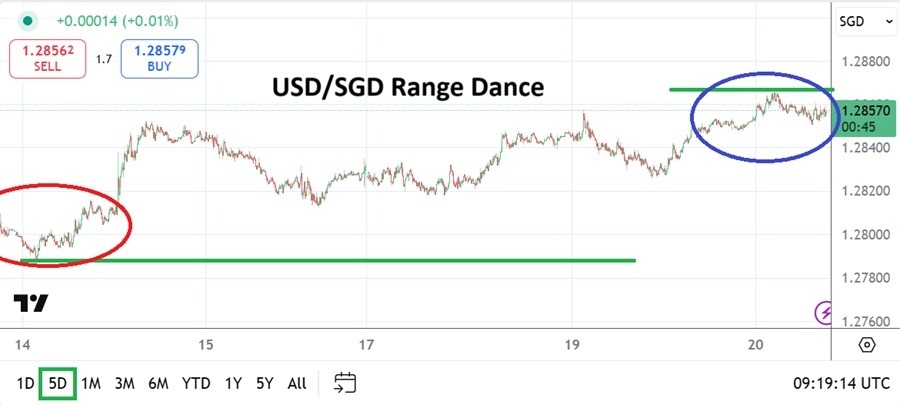

The USD/SGD is near 1.28570 as of this writing, this after moving higher the past handful of days as the broad Forex market has become cautious and kept the currency pair within a known range.

As of this writing the USD/SGD is within the upper part of its near-term range as it touches the 1.28570 vicinity, this as full trading creates quick fluctuations. The USD/SGD was trading near the 1.27885 ratio last Thursday, but has seen an upwards climb develop since then. While the movement of the USD/SGD may look like it has moved a great deal to day traders who are motivated by incremental moves in the currency pair, the range of the USD/SGD remains known.

Cautious sentiment has come into the USD/SGD over the past handful of days and slight buying has been seen. Yet, the upwards momentum in the USD/SGD is actually quite polite. The near-term looks as if its highs are threatening to storm upwards, but technically via a one month chart the USD/SGD remains almost in the middle of its range – and calm.

Resistance Levels of 1.28650 Considered

The U.S will have a large amount of Fed members speaking today at various events. These speeches will be occurring just one day before the Fed’s Jackson Hole Symposium gets underway. The notion that financial institutions want to practice caution before the big central bank get together in Wyoming with important global participants attending is likely correct. The 1.28650 level looks to be intriguing resistance in the USD/SGD.

Top Regulated Brokers

While the Fed is anticipated to cut interest rates in September, there is still a lot of room for potential debates to brew between Fed Chairman Jerome Powell and President Donald Trump. The USD/SGD like all other currencies will feel the tension of the unfolding Fed event over the next few days. The current realms of the USD/SGD are likely to remain within known values, but sentiment shifts will certainly occur.

Near-Term Sentiment as FOMC Members Speak

If the current perception of 1.28650 holds as an upper tier in the USD/SGD today and into tomorrow, this might indicate that financial institutions think the currency pair will again start to push lower. However, additional impetus will likely be needed via some dovish statements from more than a couple of FOMC members today and tomorrow to make this shift a strong one.

- Yes, tariff shadows remain over the global economy, but fear levels regarding actual duties imposed on nations continues to be treated with respect instead of fear.

- Forex has become cautious.

- The results in the USD/SGD are correlating to the broad market and the idea that the Singapore Dollar may be able to get stronger against the USD mid-term remains a sticky thought.

Singapore Dollar Short Term Outlook:

Current Resistance: 1.28590

Current Support: 1.28540

High Target: 1.28650

Low Target: 1.28420

Want to trade our daily forex analysis and predictions? Here's the best forex brokers in Singapore to check out.