- Let’s downplay for a moment the Alaska Summit that took place on Friday between Donald Trump and Vladimir Putin, and then let’s dismiss it altogether by saying the outcome of the meeting is likely not going to affect outlook on WTI Crude Oil.

- Some media sources forecasted noise from the Alaska peace talks would create volatility in the energy sector, but leading up to the summit no real volatility was seen in WTI Crude Oil.

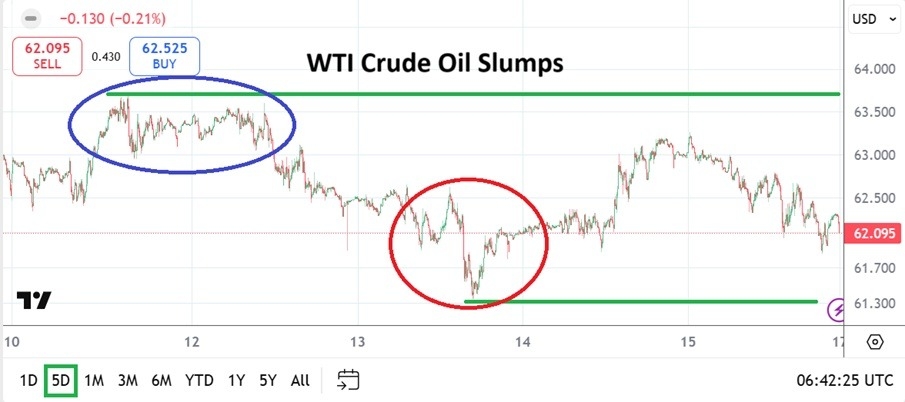

- The commodity went into this weekend slumping to lows and hovering slightly above 62.000 USD per barrel in futures markets per October prices.

- The supply of Crude Oil remains strong worldwide. The Alaska Summit is not likely to have an effect on where buyers are placing their orders in the physical world. Russia remains a large supplier to India and this seems unlikely to change and even if it did because of U.S pressure, the influence on the price of WTI Crude Oil would probably be rather muted.

Steady Supply Contemplated in WTI Crude Oil

The ability of WTI Crude Oil to remain rather comfortably below the 63.500 level early last week started to prove intriguing by late Tuesday and the remainder of the week saw price action below 63.200 a lot of the time. The move lower on Friday before the results of the Alaska Summit were known is an indication that large players were not worried about potential outcomes from the talks between President Trump and President Putin.

Top Regulated Brokers

The results of the Alaska talks remain unclear and this will not change as tomorrow’s trading opens in WTI Crude Oil. The point being that more talks are certainly going to be needed and this was the expected outcome by many experienced WTI Crude Oil traders. And again, even if there had been a wildly loud disagreement, the price of WTI Crude Oil would not have suffered with sudden buying. Why? Because supply remains steady worldwide via comfortable producers.

62.000 as a Target and Chance for Lower Values

Many day traders may hold the notion that WTI Crude Oil is vastly oversold when they consider the historical prices of the commodity and its ability to trade at vastly higher numbers. Yet, global prices for Crude Oil remain within a solid realm that is rather consolidated. The inability of WTI Crude Oil to move above 63.500 this past week after Tuesday, and lack of a serious challenge to the 64.000 level is a signal buyers remain relaxed and are not rushing into the energy sector to secure supplies.

- Steady usage is being helped by the notion that WTI Crude Oil is readily available.

- Certainly higher ratios will be seen, reversals remain a constant threat in WTI, but sudden moves above 66.000 to 68.000 even if they were to occur would still be within a manageable price for the commodity per most users.

- And until the 64.500 realm is challenged, price may simply continue to trade within lows.

- Day traders may want to contemplate the notion of lower values actually being seen in the coming week that test the 62.000 to 61.50 ratios.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 59.500 to 65.100

Speculators should be wary of false narratives in WTI Crude Oil that seek attention with loud headlines claiming the commodity will become volatile because of negotiations between Russia and the Ukraine. The war in Europe has been going on for a while, experienced large players know the trading terrain in WTI Crude Oil.

Calm pervades for the moment, and is unlikely to change this coming week. The downside price action in WTI Crude Oil shows behavioral sentiment is rather confident and unlikely to suddenly become nervous. Speculative buying from large players representing clients seeking to secure WTI Crude Oil at the current lower prices may be a reason for the commodity to move higher, but day traders should not bet on things they do not have evidence unless a sustained trend upwards develops.

Ready to trade our weekly forecast? Here’s a list of some of the best Oil trading platforms to check out.