Long Trade Idea

Enter your long position between $121.84 (Friday’s intra-day low) and $126.08 (the intra-day high of the last bullish candle).

Market Index Analysis

- Airbnb (ABNB) is a member of the NASDAQ 100 and the S&P 500.

- Both indices push higher, but downside risks are rising.

- The Bull Bear Power Indicator for the NASDAQ 100 shows a negative divergence and does not confirm the uptrend.

Market Sentiment Analysis

The NASDAQ closed at a fresh record, and major indices had a powerful run last week amid hopes for a 25 to 50-basis-point interest rate cut this week, with expectations for further reduction at each FOMC meeting for the rest of 2025. Investors chose to ignore sticky inflation and bet that weak labor market data would prompt interest rate cuts. The second-quarter earnings season is winding down, but FedEx is poised to grab investors’ attention. It serves as a global barometer for trade, especially after weak Chinese data.

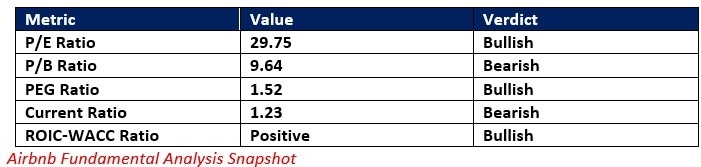

Airbnb Fundamental Analysis

Airbnb is the best-known online marketplace and broker for short-term rentals and long-term homestays. Despite its permanent ban on parties and events, the company continues to face stiff opposition to its properties in core markets. Still, it has announced plans to become an Everything App powered by AI.

So, why am I bullish on ABNB at current support levels?

While Airbnb faced issues with its acceptance rate among its neighbors, the latest announcement to become an everything app powered by AI provides intriguing new business avenues. ABNB has excellent operational statistics and plans to invest up to $250 million to transform its app into a lifestyle app. I believe it will more than offset the negative impact of new regulatory restrictions on short-term rentals.

The price-to-earning (P/E) ratio of 29.75 makes ABNB an inexpensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 35.72.

The average analyst price target for ABNB is $138.12. It suggests moderate upside potential with exciting growth opportunities that could elevate prices above its current target.

Airbnb Technical Analysis

Today’s ABNB Signal

ABNB Price Chart

- The ABNB D1 chart shows price action just above its horizontal support zone.

- It also shows price action between its descending 38.2% and 50.0% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with an ascending trendline.

- The bullish trading volumes at core support levels are higher than average bearish trading volumes.

- ABNB corrected as the NASDAQ 100 pushed higher, a bearish trading signal that is gradually decreasing.

Top Regulated Brokers

My Call on Airbnb

I am taking a long position in ABNB between $121.84 and $126.08. I buy into the Everything App transformation story, with the current PEG ratio, which confirms undervalued share prices. Airbnb also has excellent operational statistics that support the app changes.

- ABNB Entry Level: Between $121.84 and $126.08

- ABNB Take Profit: Between $148.64 and $152.30

- ABNB Stop Loss: Between $113.40 and $116.72

- Risk/Reward Ratio: 3.18

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.