- The Australian dollar did initially rally pretty significantly during the trading session here on Friday after the non-farm payroll announcement came out much weaker than anticipated.

- As a result, it does make a certain amount of sense that the U S dollar would lose some strength.

- However, this wasn’t completely true on Friday as traders could be looking to run to safety at this point in time.

Very Familiar Level

Top Regulated Brokers

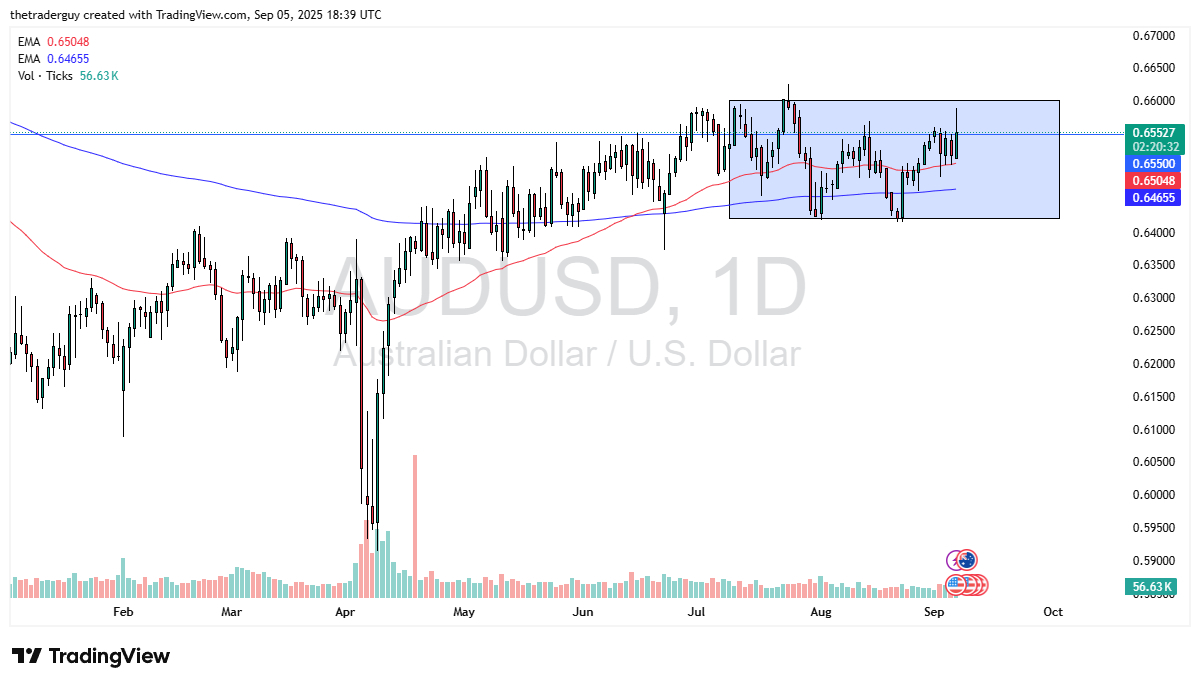

That being said, at the end of the session, we find ourselves at the 0.6550 level yet again. So quite frankly, if the Australian dollar won't be able to take advantage of this weakness in the US economy, it's probably not going to. Furthermore, you should keep in mind that the Australian dollar has been a little bit lackluster against the US dollar in comparison to other currencies and it's also probably worth noting that the Australian dollar is very sensitive to risk appetite.

And you do have to keep in mind that if the U S economy is slowing down in the jobs market search the full part that has a massive influence on what happens with global trade. After all the United States consumes by far the largest share of goods and services in the world.

If there are no buyers of ‘things’, you have a problem in other economies as well. Further beyond that, I would take a look at the way the Aussie has performed. While other currencies went straight up in the air, the Australian dollar did the same thing and then just ended up grinding sideways more than anything to the side as we are just trying to sort out where we're going longer term. Ultimately, I think we're still range-bound and after a non-farm payroll that we got such bad news, that might actually be pro-US dollar.

Ready to trade our daily Forex analysis? Here's a list of the best licenced forex brokers in Australia to choose from.