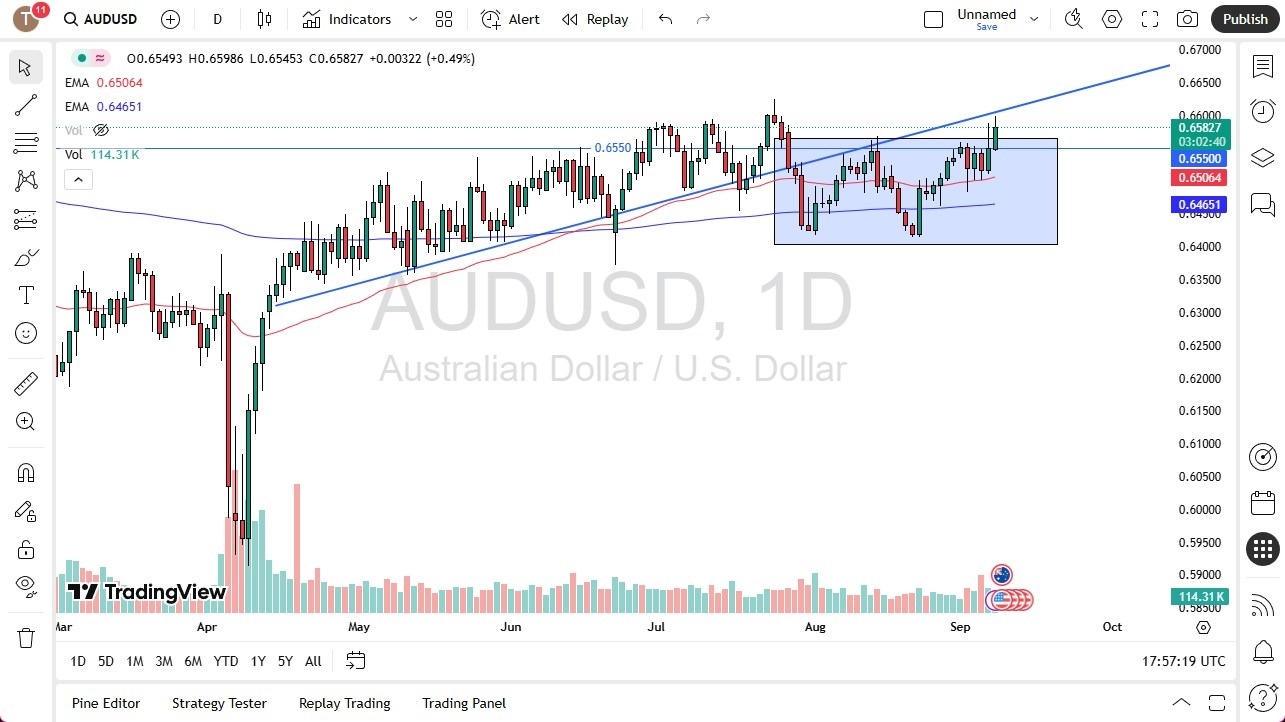

- The Aussie dollar has rallied uh during the session here on Monday, but it is struggling in a very familiar area.

- We are just shy of the 0.66 level. And you can also make an argument that there is a previous trend line that is now acting as resistance as well.

- The Aussie has been a bit lackluster in comparison to other currencies around the world when it comes to the US dollar, and it must be said that even the ones that have been a bit stronger, despite being positive for the day, it's not like they've torn apart the US dollar.

I think you've got a situation where traders are going to be looking at the charts through the prism of, yes, we know that the Federal Reserve is going to cut interest rates here in a couple of weeks, and they very well could in December.

Top Regulated Brokers

What Do Rate Cuts Mean?

But what does that say about the global economy? Is the United States going to drag the rest of the global economy down with it? It will. They always say this time is different, but it never is. So, I think at this point in time, if the Australian dollar were to drop back below the 0.6550 level, it's likely that we would see a bit of selling pressure.

I've got no interest in buying this pair, but if we were to break above the 0.6650 level, then I would have to rethink my entire attitude about it. It's worth noting that even if the US dollar starts selling off against everything else, other currencies will probably outshine the Aussie anyway. That's how it's been since the middle of April. That has not changed. On the other hand, if everybody runs the US dollar as far as the Forex markets are concerned out of fear, the Aussie is going to get absolutely pummeled.

Ready to trade our daily AUD/USD Forex analysis? Check out the best forex trading platform for beginners Australia worth using.