Short Trade Idea

Enter your short position between 50.64 (the lower band of its horizontal resistance zone) and 51.63 (the upper band of its horizontal resistance zone).

Market Index Analysis

- Bank of America (BAC) is a member of the S&P 100 and the S&P 500.

- Both indices show bullish exhaustion with contracting trading volumes.

- The Bull Bear Power Indicator for the S&P 500 shows a negative divergence and does not confirm the uptrend.

Market Sentiment Analysis

The US Federal Reserve delivered its first interest rate cut of 2025. As expected, the FOMC lowered interest rates by 25 basis points, and predicts two more cuts for the rest of the year. The Dot-Plot Chart shows the division among Fed officials is wide on future monetary policy, with six members seeing no more cuts, two being comfortable with one more cut, and nine recommending two more cuts. Equity markets moved lower in volatile trading, as yesterday’s Fed action spiked stagflation risks.

Bank of America Fundamental Analysis

Bank of America is a financial services holding company that handles roughly 10% of all US deposits. It is one of the Big Four US banking institutions and one of eight systemically important financial institutions.

So, why am I bearish on BAC after its recent advance?

The 25-basis-point interest rate cut delivered yesterday will do little to address the high debt-to-equity ratio. It will have a more substantial negative impact on its fixed income portfolio earnings potential. Profit margins have been contracting for years, and I predict an acceleration of the trend. Labor costs will also increase after it raised its minimum hourly wage to $25 per hour, worsening the fundamental outlook.

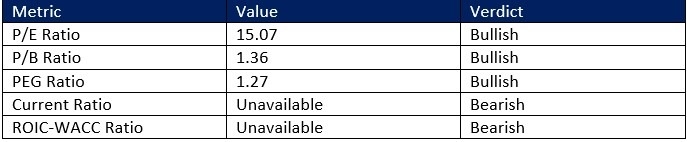

Bank of America Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 15.07 makes BAC an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.53.

The average analyst price target for BAC is 53.69. It suggests limited upside potential, with increasing downside risks.

Bank of America Technical Analysis

Today’s BAC Signal

- The BAC D1 chart shows price action inside its horizontal resistance zone with a rising wedge formation adding breakdown pressures

- It also shows price action trading between its ascending 0.0% and 38.2% Fibonacci Retracement Fan

- The Bull Bear Power Indicator is bullish, but shows a negative divergence

- The average bearish trading volumes are higher than the average bullish trading volumes

- BAC moved higher with the S&P 500, a bullish confirmation, but breakdown pressures have increased

My Call

I am taking a short position in BAC between 50.64 and 51.63. Bank of America has a wobbly balance sheet, and interest rate cuts will do more harm than good to its already contracting profit margins. I am selling the pending breakdown.

- BAC Entry Level: Between 50.64 and 51.63

- BAC Take Profit: Between 42.35 and 43.66

- BAC Stop Loss: Between 53.69 and 54.76

- Risk/Reward Ratio: 2.72

Ready to trade our daily signals on stocks? Here is our list of the best brokers for trading worth reviewing.