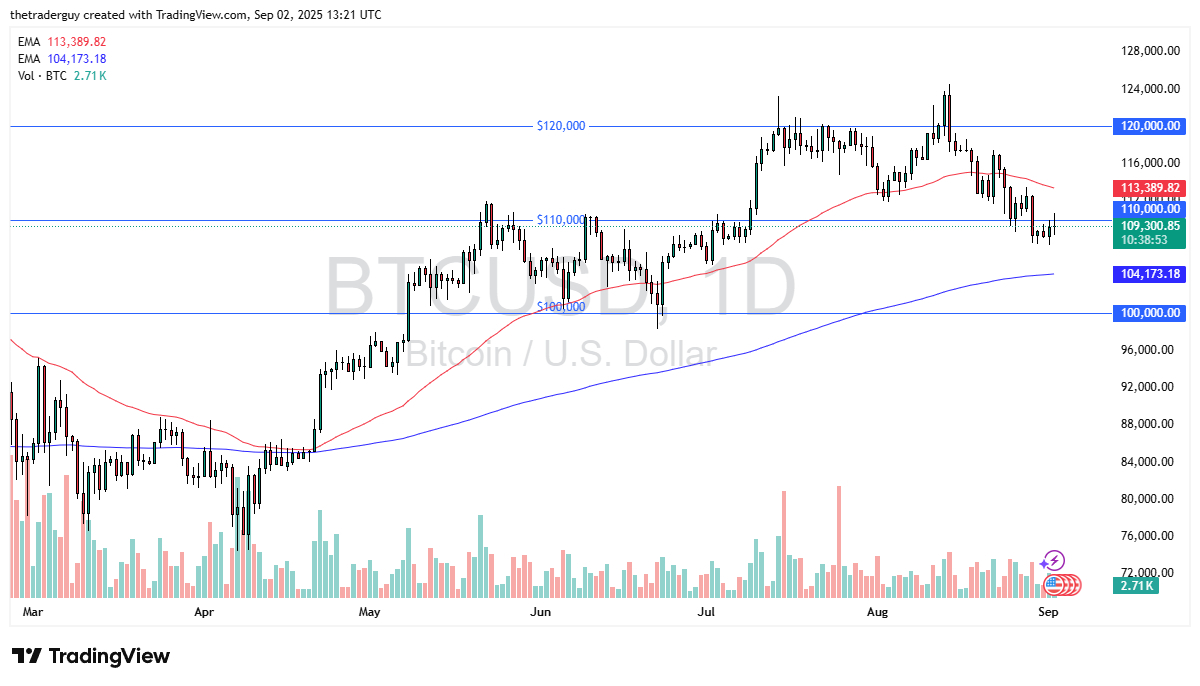

- The Bitcoin market has been back and forth during the entire trading session here on Tuesday with the $110,000 level being a bit of a magnet for price.

- The candlestick so far looks as if it is a market that is confused and doesn't really know what to do.

- That's not really a huge surprise considering how much uncertainty there is when it comes to monetary policy, while people do expect the Federal Reserve to cut raids, the reality is, is it a sign of weakness? Are there more significant underlying concerns out there? Because if there are, then taking risk in Bitcoin is probably not going to be high up on the priority of most institutional traders.

US Dollar and Fed

Top Regulated Brokers

On the other hand, if we get a slow and steady managed decline of the US dollar, that could be beneficial for Bitcoin. As things stand right now, we are not only at the $110,000 region, but we are also right in the middle between the 50-day EMA above and the 200-day EMA below.

With that being the case, the market is likely to continue to see a lot of choppy behavior because when you're between these two EMAs a lot of times, it's a bit of a coin flip as to the next direction. I do believe ultimately, Bitcoin will continue to go higher, but I also recognize that there is a lot of uncertainty out there.

And of course, institutional traders have been gone for the last month or so on whole as they typically take vacations this time of year and volume might be a little bit soft. I don't have any interest in shorting Bitcoin. But if we were to break down below the 200 day EMA, currently just above the $104,000 level, then we can start to ask questions. Until then, it just looks like we're in the midst of a pretty significant correction.

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.