Today’s BTC/USD Signals

Long Trade Idea

- Long entry between $109,907 and $110,621, the lower and upper bands of a small horizontal support zone that support more upside.

- Place your stop-loss level at $200 below your entry level.

- Adjust the stop-loss to break even once the trade is $500 in profit.

- Take off 50% of the position as profit when the price reaches $500 in profit and leave the remainder of the position to run.

Short Trade Idea

- Short entry if price action breaks down below $109,407, $500 below the lower band of its horizontal support zone.

- Place your stop-loss level $200 above your entry level.

- Adjust the stop-loss to break even once the trade is $500 in profit.

- Take off 50% of the position as profit when the price reaches $500 in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside, or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

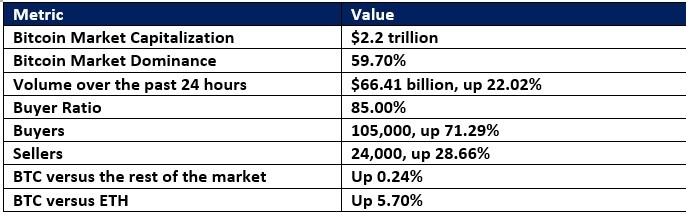

BTC/USD Fundamental Analysis

Noteworthy Developments to Consider:

- Over the past 24 hours, X has shown 49.33% of bullish Bitcoin tweets versus 25.55% of bearish Bitcoin tweets from 162,786 tweets.

- Over the past 24 hours, Reddit featured 9,754 Bitcoin posts with 73,139 comments. The posts received fewer upvotes than downvotes by the community, but the comments received more upvotes than downvotes.

- Long-term Bitcoin holders have liquidated positions, but Bitcoin overcame the selling pressure to power forward.

So, why am I bullish on BTC/USD following its breakout sequence?

I expected a breakout in BTC/USD yesterday, and Bitcoin delivered. It crushed its descending 38.2% Fibonacci Retracement Fan level and pushed past its 50.0% Fibonacci Retracement Fan level. I noted a potential continuation of the breakout sequence into 111,105, the intra-day high before a reversal, as the next target, and I believe we can reach it as soon as today. A breakout above the descending 61.8% Fibonacci Retracement Fan level should push prices higher.

Trading volumes have increased during the breakout sequence, and the Bull Bear Power Indicator has been in bullish territory for nine hours. I expect volatility to increase as bulls and bears wrestle for control at a crucial resistance level.

A potential flag chart pattern is forming, a bullish continuation pattern, which could lead to a spike in price action following a breakout. Crypto traders should get $500 to $750 from this long position, but it could magnify with a breakout above the 61.8% Fibonacci Retracement Fan.

Ready to trade our free crypto signals? Check out our list of the best MT4 crypto brokers.