Long Trade Idea

Enter your long position between 94.90 (the intra-day low of its last bearish candlestick) and 98.71 (yesterday’s intra-day high).

Market Index Analysis

- Dollar Tree (DLTR) is a member of the S&P 500

- This index shows bullish exhaustion with contracting trading volumes

- The Bull Bear Power Indicator for the S&P 500 shows a negative divergence and does not confirm the uptrend

Market Sentiment Analysis

The US Federal Reserve delivered its first interest rate cut of 2025. As expected, the FOMC lowered interest rates by 25 basis points, and predicts two more cuts for the rest of the year. The Dot-Plot Chart shows the division among Fed officials is wide on future monetary policy, with six members seeing no more cuts, two being comfortable with one more cut, and nine recommending two more cuts. Equity markets moved lower in volatile trading, as yesterday’s Fed action spiked stagflation risks.

Dollar Tree Fundamental Analysis

Dollar Tree is a discount store with over 15,000 stores and 24 distribution centers across the continental 48 US states and over 200 stores in Canada. It competes in the low-end retail segment.

So, why am I bullish on DLTR despite its double-digit sell-off?

I am cautiously optimistic about the new Chief Merchandising Officer and the positive transition in its stores. Operating margins are among the best in the industry, and the latest earnings release noted two-thirds of new store traffic from higher-income shoppers, which could boost overall revenue per shopper. The Uber Eats partnership could also add to market outperformance.

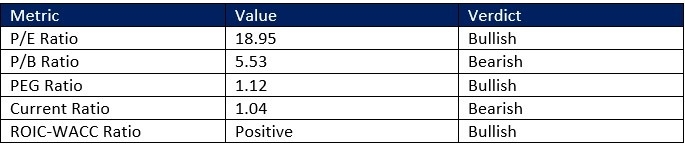

Dollar Tree Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 18.95 makes DLTR an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.53.

The average analyst price target for DLTR is 112.30. It suggests moderate upside potential, with acceptable downside risks.

Dollar Tree Technical Analysis

Today’s DLTR Signal

- The DLTR D1 chart shows price action inside its horizontal support zone

- It also shows price action trading between its descending 0.0% and 38.2% Fibonacci Retracement Fan

- The Bull Bear Power Indicator is bearish, but shows a positive divergence, and is nearing a bullish crossover

- The average bearish trading volumes are higher than the average bullish trading volumes

- DLTR moved lower while the S&P 500 set a fresh all-time high, a bearish signal, but bullish catalysts dominate

Top Regulated Brokers

My Call

I am taking a long position in DLTR between 94.90 and 98.71. The Dollar Tree business model is well-positioned to navigate the current economic climate. The new Chief Merchandising Officer could also capitalize on foot traffic from higher-income earners. Therefore, I am buying the dip, as valuations and the PEG ratio suggest higher prices ahead.

- DLTR Entry Level: Between 94.90 and 98.71

- DLTR Take Profit: Between 115.74 and 118.06

- DLTR Stop Loss: Between 86.01 and 90.10

- Risk/Reward Ratio: 2.34

Ready to trade our daily signals on stocks? Here is our list of the best brokers for trading worth reviewing.