- The Euro rallied to kick off the trading week on Monday but then turned around to show signs of hesitation.

- That’s not a huge surprise, because we have seen a lot of sideways action over the last several weeks, and there seems to be a lot of concern out there as to where we are going next.

- Ultimately, this is a market that is trying to figure out where we are going next, mainly due to uncertainty about what the Federal Reserve cutting rates later this year might actually mean.

Multiple Issues

Top Regulated Brokers

While the Federal Reserve cutting interest rates later in the year is a sign that the US dollar could soften, it also is historically speaking, right before we start to see a lot of stress in the financial markets. If that’s going to be the case, then you could see a situation where ironically, the US dollar tends to strengthen and that environment. This does make sense if you think about it, because a lot of traders will be looking to protect their capital, meaning that they will be buying bonds, which of course will require US dollars. Initially, we often see the US dollar take a bit of a beating on the way to the rate cuts, only to see it strengthen due to fear. However, at the moment you need to realize that volume is probably a bit thin as traders are on holiday.

Technical Analysis

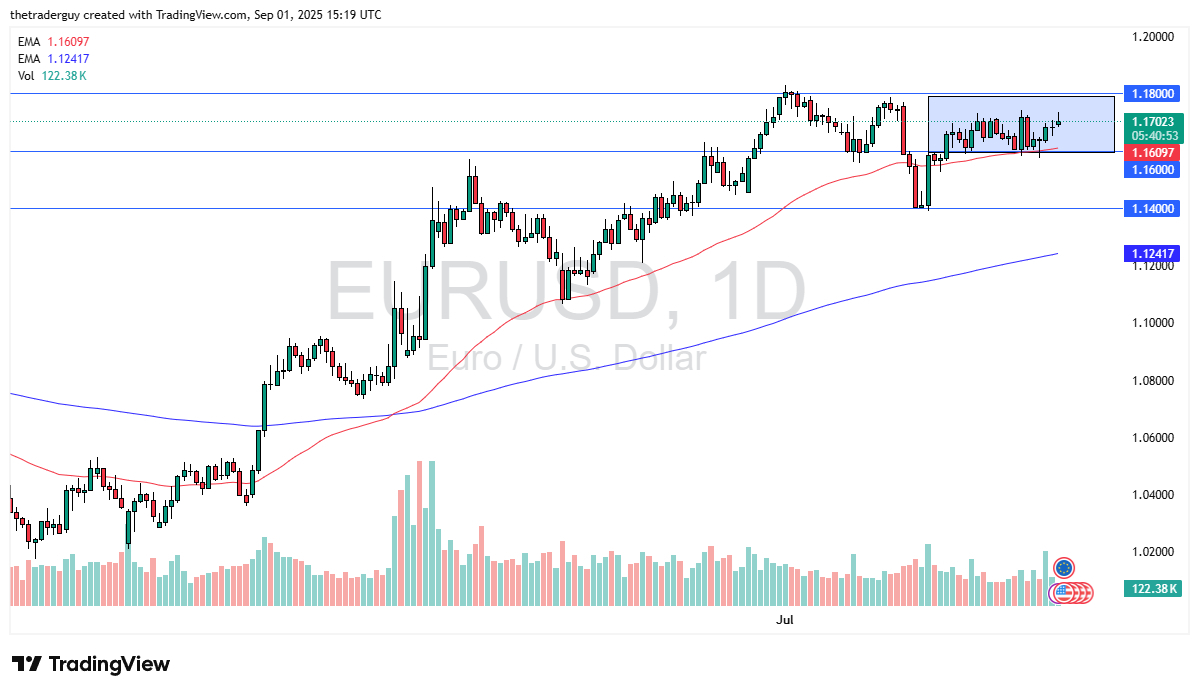

The technical analysis obviously is very sideways at the moment and has a couple of very obvious levels that we are trading around right now. The 1.16 level is significant support, with the 50 Day EMA sitting just above it. On the upside, we have the 1.18 level, which could offer a significant amount of resistance based on previous action in that neighborhood. In other words, I think we are stuck in a tight range, trying to determine where risk appetite is going to go. If we break down below the 1.16 level, then you have a situation where we could drop to the 1.14 level. That’s an area where we had seen significant support previously. Anything under that level would send the euro plunging.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.