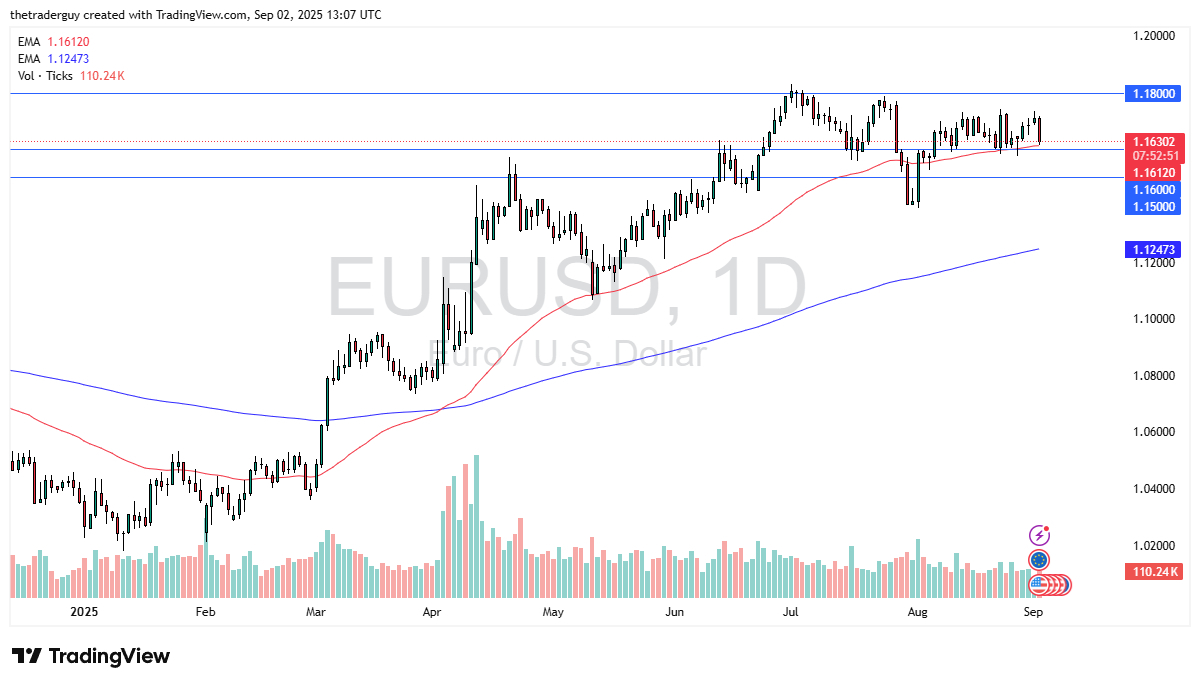

- The Euro has fallen pretty significantly against the US dollar in early trading on Tuesday, as we touched the 50 day EMA and now look very likely to continue to see a little bit of noise in this region.

- The 1.16 level is an area that I would pay close attention to because I do believe that it starts a significant amount of support all the way down to the 1.15 level.

- Above, we have the 1.1750 level, an area that I think extends all the way to the 1.18 level as resistance.

All things being equal, I think a lot of what we're seeing here is a market that's waiting to see what the Federal Reserve does and in the short term, waiting to see what the jobs number will be coming out of the United States, as the non-farm payroll announcement comes out on Friday, that could give us a little bit of a heads up as to the environment that the Fed is dealing with. But I think ultimately this is a situation where we probably remain range bound for a couple of weeks.

The Federal Reserve

Top Regulated Brokers

It'll be interesting to see the reaction to the Federal Reserve's rate cut and perhaps more importantly, its statement in the middle of the month of September, because if there is fear, it might initially be negative for the US dollar, but eventually all roads lead to the US treasury market, meaning that the US dollar could very well strengthen as a result. Bond markets are starting to blow out and starting to perhaps suggest that the strength may lie with the US dollar eventually.

It is worth noting that we had shot higher, shot higher, again, and then this last move higher has seen a lot more volatility. Are we topping out? I think we may be getting close to that. But as things stand right now, at least in the short term, I expect a lot of back and forth trading in about a 150 pip range between 1.16 and 1.1750.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.