- The euro rallied after initially trying to drift a bit lower during the Wednesday session, as we continue to see a lot of nonsensical sideways action in the Forex markets.

- This does make a certain amount of sense, as we have the Non-Farm Payroll announcement coming out on Friday, and traders will be worried about their positions ahead of that time.

- Furthermore, we have Wall Street returning from vacation, and that brings in more volume, so markets at this point in time could start to stabilize a bit overall.

That will have a direct influence on this market, because it is so heavily influenced by risk appetite. As things stand right now, in other assets such as indices, it seems that on a day-to-day basis nobody really knows what they want to do with themselves.

Top Regulated Brokers

Technical Analysis

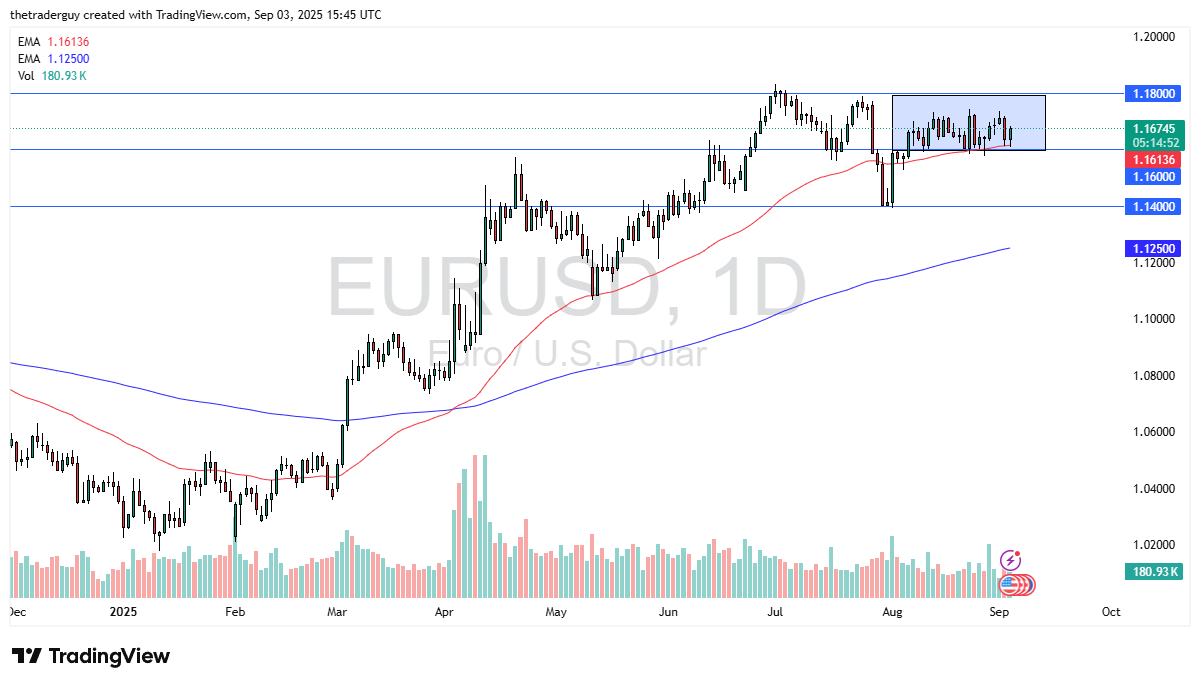

The technical analysis is very flat and lackluster at the moment as there is no real conviction. At this point, the markets continue to be more of a short-term back and forth type of environment, and I think a lot of traders will continue to look at it through that prism. The 1.16 level below is significant support, especially now that the 50 Day EMA sits right there as well.

With that being the case, it does make a certain amount of sense that we would see questions asked of whether or not that could hold. On the upside, you have the 1.17 level offering a zone of resistance that extends to the 1.18 level. Until we get through the Non-Farm Payroll announcement, I think you are going to see a market that doesn’t really know what to do with itself, and therefore you will be sticking to short term charts to trade the latest little micro movement. Once we get through that announcement, then we will see which direction we break out of this consolidation in order to sort out where we are going longer term. With that being said, I’m pretty neutral on this market.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.