- The Euro rallied significantly during the trading session on Friday after the Non-Farm Payroll announcement came out weaker than anticipated.

- The United States added 22,000 jobs for the month of August, instead of the 75,000 expected.

- With that being the case, traders are starting to bet on the idea of the Federal Reserve getting aggressive with its rate cuts.

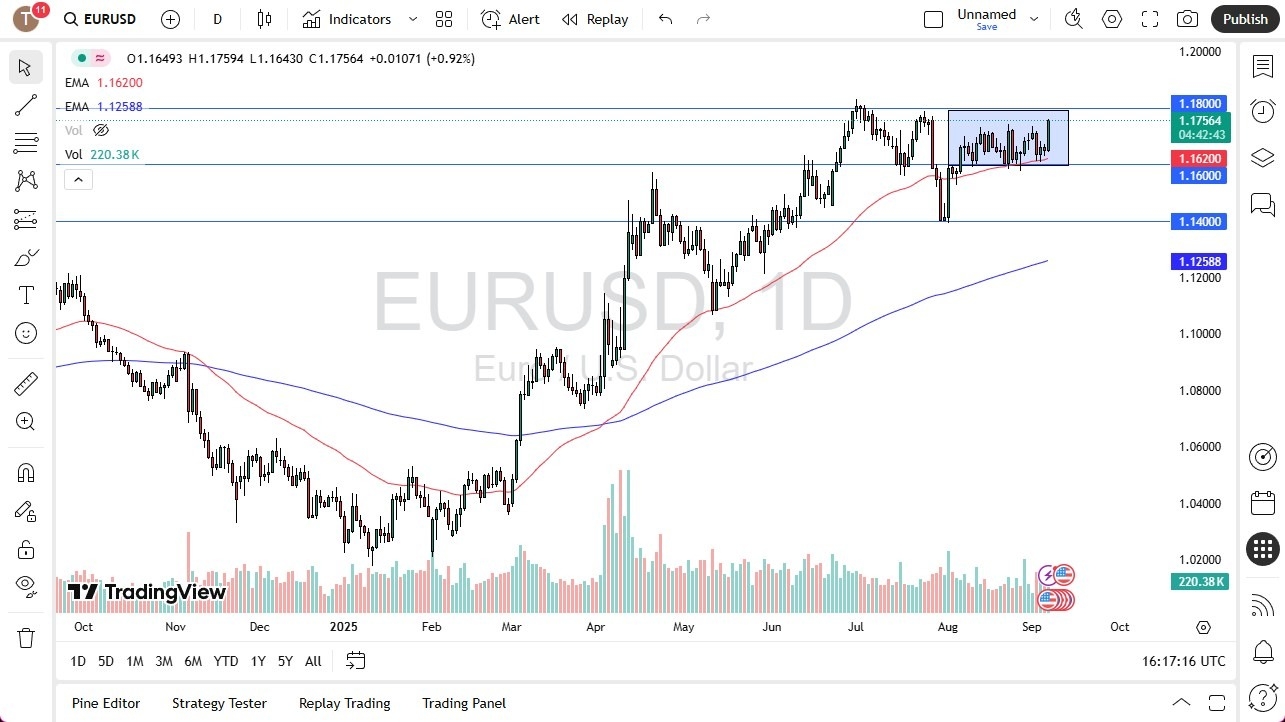

- Ultimately, this is a market that will continue to be very noisy, but at the end of the day, we are still within the basic trading range.

US Trading Session

Top Regulated Brokers

It might be worth noting that the Euro gained a bit during the US trading session, as is typical, American traders sold off the US dollar. That being said, we are still within the range that we have been in, and I will be watching the 1.18 level. The 1.18 level being broken to the upside could send the euro toward the 1.12 level, but I would also not be surprised to see a little bit of a correction as we start the next week, because that happens a lot during the Non-Farm Payroll sessions.

After all, traders will rethink what’s going on, and there’s a very real world in which we start to question whether or not the US economy is slipping, and if and when the US economy slips, typically the global economy starts to have problems. If that ends up being the case, then the Euro may suffer at the hands of this. The euro is considered to be “riskier” than the US dollar, although it’s not necessarily considered to be a “risky currency.” This is because we are starting to see traders pile into the bond market, and if that ends up being the case, it demands US dollars.

If we do fall from here, the 50 Day EMA sits at the 1.1619 level and is rising. The 1.16 level should offer support, and if we break down below the 1.14 level it is more likely than not going to be the and target. Ultimately, I think you’ve got a situation where traders are going to be very cautious and very erratic over the next couple of days, especially as we start to look toward the September FOMC Meeting.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.