Today’s EUR/USD Signal

Long Trade Idea

- Long entry between $1.17047 and $1.17145, the support zone that should keep bullish momentum intact.

- Place your stop-loss level 10 pips below your entry level.

- Adjust the stop-loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Short Trade Idea

- Short entry if price action reverses and falls below $1.17047, the lower band of its horizontal support zone.

- Place your stop-loss level 10 pips above your entry level.

- Adjust the stop-loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Top Regulated Brokers

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside, or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

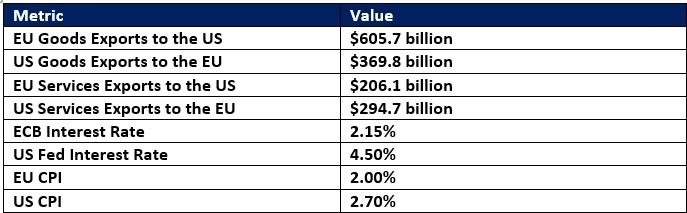

EUR/USD Fundamental Analysis

So, why am I bullish on the EUR/USD after its multi-day rally?

After the EUR/USD recorded an intra-day low of $1.15738, price action resumed its longer-term upside move driven by persistent US Dollar weakness. A bullish price channel formed, and I believe this currency pair will continue to ride the bullish wave higher.

The Bull Bear Power Indicator turned bullish on August 29th, 2025, and has supported the most recent push higher after the last time the EUR/USD touched the ascending support level of its bullish price channel at $1.16515.

While bullish momentum remains intact as long as the EUR/USD trades inside its bullish price channel, I will monitor price action for a potential momentum switch if it reverses below $1.16881. Forex traders should get 25 to 35 pips from this long position.

EUR/USD Price Chart

There is nothing of high importance scheduled today concerning either the EUR or the USD. It is a public holiday today in the USA.

Ready to trade our daily Forex signals? Check out our list of the top 100 Forex brokers.