Today’s EUR/USD Signals

Long Trade Idea

- Long entry between $1.16484 and $1.16696, the intra-day low confirming the bullish price channel, and the intra-day high marking the mid-level of the bullish price channel.

- Place your stop-loss level 10 pips below your entry level.

- Adjust the stop-loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Short Trade Idea

- Short entry if price action reverses and falls below $1.16120, ten pips below the intra-day low that started the lower band of its bullish price channel.

- Place your stop-loss level 10 pips above your entry level.

- Adjust the stop-loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Top Regulated Brokers

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside, or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

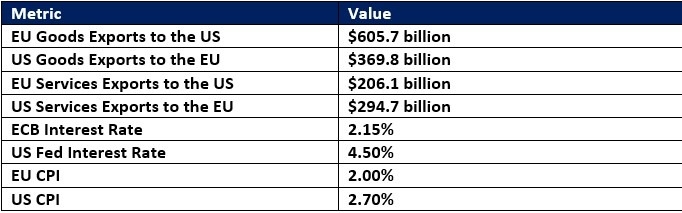

EUR/USD Fundamental Analysis

Economic data worth considering:

- The Eurozone data will center on July retail sales, expected to reverse the 0.3% month-over-month increase in June. Economists anticipate a 0.3% month-over-month contraction and a 2.4% year-over-year rise. The annualized figure compares to June’s expansion of 3.1%.

- Today’s US ADP report will capture the focus of traders, expected to show only 73K job creations in the private sector for August, down from July’s low reading of 104K. Additional labor data includes initial jobless claims, the Challenger Job Cuts report, and second-quarter unit labor costs and non-farm productivity.

- The ISM Non-Manufacturing PMI for August could also move the US Dollar. Economists expect an increase from July’s 50.1 to 50.9. Traders should also monitor the Prices Paid component. The S&P Global Services PMI and the S&P Global Composite PMI will also be released.

- July’s US trade deficit is expected to widen to $77.7 billion from June’s deficit of $60.2 billion.

So, why am I bullish on the EUR/USD after its breakout sequence?

I expected yesterday’s breakout to continue, and the EUR/USD entered a breakout sequence above its descending Fibonacci Retracement Fan. It created a bullish price channel, and I believe it can lead price action.

The Bull Bear Power Indicator turned bullish with an ascending support line. Bullish trading volumes have risen since the confirmation of the bullish price channel. I expect weaker-than-expected US economic data, which should boost the EUR/USD in the afternoon session.

Top Regulated Brokers

Volatility could increase as traders brace for tomorrow’s NFP report, and I will monitor price action for a potential momentum switch if it reverses below 1.16386. A horizontal support zone below the bullish price channel should limit downside potential. Forex traders should get 25 to 35 pips from this long position.

EUR/USD Price Chart

There is nothing of high importance due today regarding the Euro. Concerning the US Dollar, there will be a release of the ADP Non-Farm Employment Change Forecast at 1:15pm London time, followed by the Unemployment Claims 15 minutes later, then ISM Services PMI at 3pm.

Ready to trade our daily Forex signals? Here is our Forex brokers list worth reviewing.