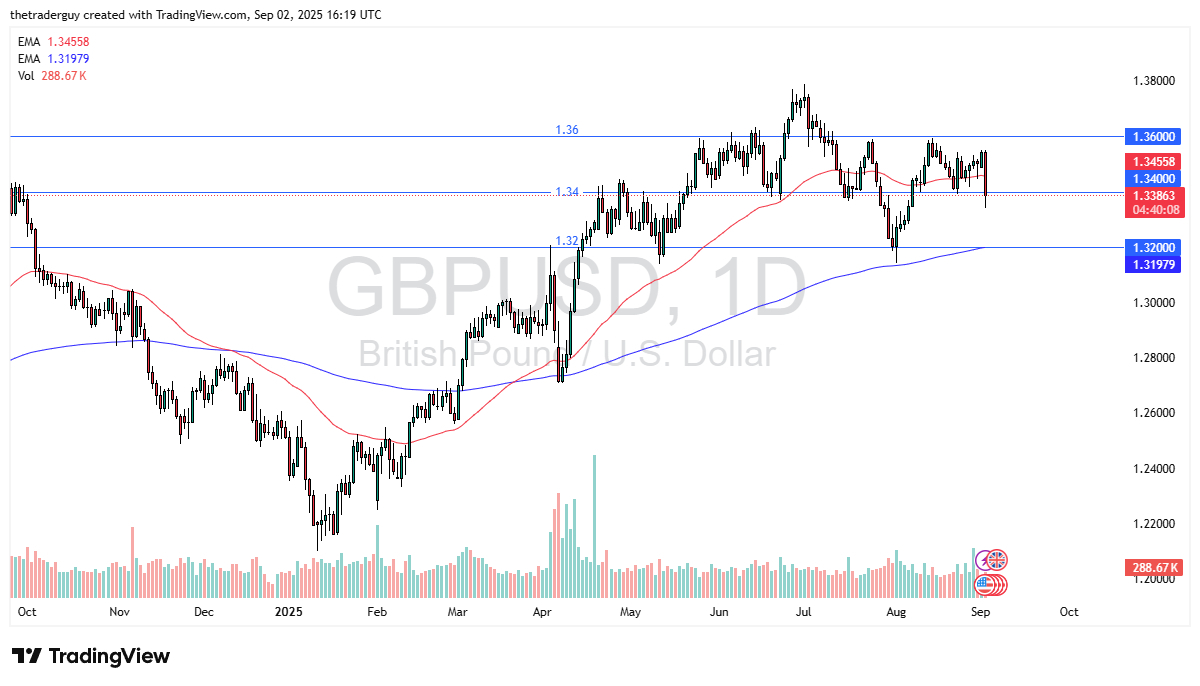

- The British pound plunged during the trading session on Tuesday to the 1.34 support level.

- This is an area that I would anticipate being important, so the fact that the market is trying to fight back is a good sign.

- However, it’s also worth noting that the US dollar found strength across the board, so if we are in fact starting to see a little bit of a sea change in attitude, the US dollar could cause a lot of havoc across the FX world.

Technical Analysis

Top Regulated Brokers

The technical analysis for this pair is somewhat sideways, with a couple of different consolidation ranges. The 50 Day EMA is very flat, so it’s not a huge surprise to see that this market is struggling to find a bigger move. The market has struggled with volume recently as well, as most institutional traders will be away for summer season holidays, and therefore you have a situation where there is a lot of confusion when it comes to what the Federal Reserve will do next. Nonetheless, there are couple of levels that are most certainly worth paying attention to right now.

These levels include the 1.36 level above as significant resistance, with the 1.34 level being support. Even if we were to break down below here, the British pound could see plenty of support near the 1.32 level, where it is an area that we have seen a lot of support at previously, especially now that the 200 Day EMA races toward it, it makes sense that could be the “floor in the market.

Non-Farm Payroll

Keep in mind this is a market that will be waiting to see what the job situation in the United States is on Friday as the Bureau of Labor Statistics will give its key employment figure. The market will obviously react to that, but I think we have a situation where it goes beyond NFP. There are questions about the global economy, and if it starts to fall, that could be positive for the US dollar. Between now and Friday, I would anticipate somewhat sideways action, perhaps with a little bit more of a downward bias.

Ready to trade the Forex GBP/USD analysis and predictions? Here are the best forex trading platforms UK to choose from.