- Gold fell pretty significantly to kick off the trading session here on Thursday but has turned around show signs of life.

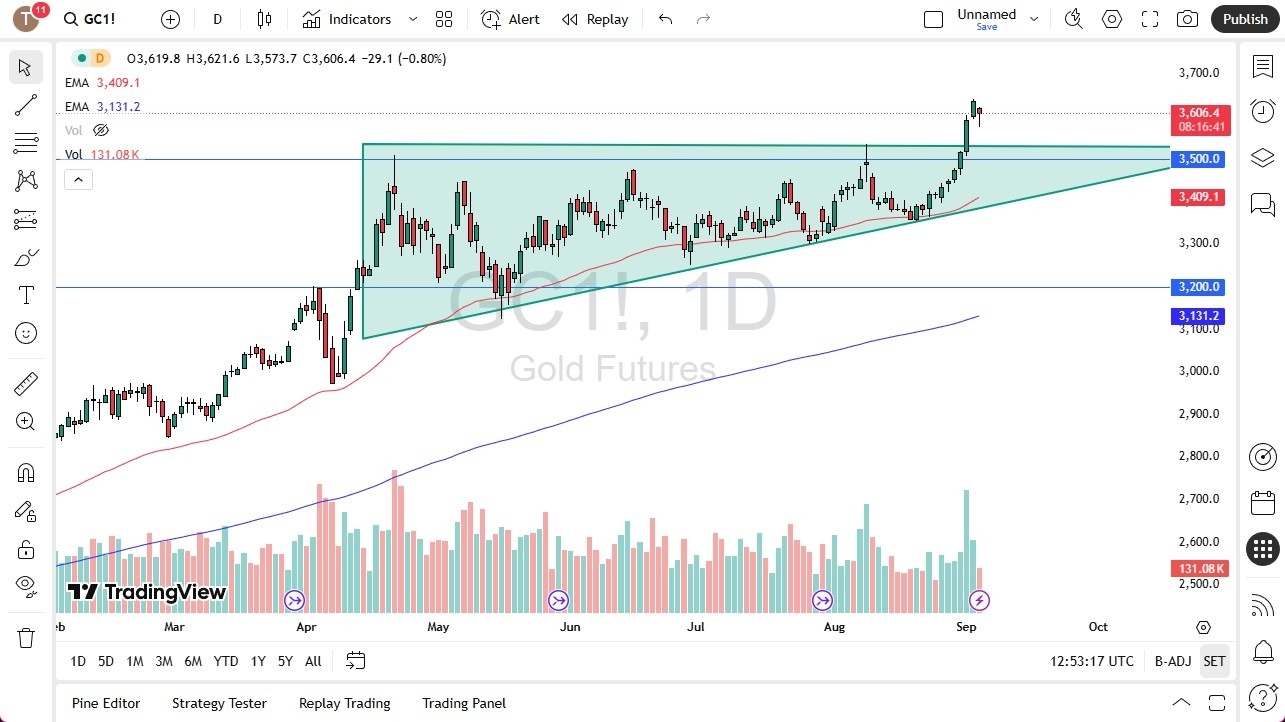

- I find this interesting because when you see an explosive breakout like we have had in the gold market over the last 10 sessions or so, there are a couple of different things that can happen.

- You can get a significant pullback and value hunting at lower levels, or you can go sideways for a bit and work off some of the excess froth.

The first candlestick of negativity suggests we may go sideways. We may not get the pullback either way. I would caution you of the fact that the Friday session is non-farm payroll announcement and with those jobs numbers a lot of volatility will come.

Top Regulated Brokers

A Drop Would Be Nice…

So, I'm hoping to get a knee jerk reaction lower so I can get involved in the gold market again, as I have already taken profit. The market of course will continue to be very noisy. But I think overall, it’s already shown what it's going to do. It's going to continue to attract buyers. There's no real reason to think that it's suddenly going to change attitude.

The non-farm payroll announcement if there is a knee jerk reaction lower, I think invites value hunters to come back in based on the measured move of the ascending triangle. The expected target is $3,800. And as quickly as we got to $3,600. I don't think that's a stretch of the imagination at all. If we somehow fall to break down below $3,500, then you talk about the 50-day EMA offer and support, but that would take a pretty significant shift in the overall attitude of this market. All things being equal, I remain bullish of gold and will continue to be so.

Ready to trade our Gold daily analysis and predictions? We’ve made a list of the best Gold trading platforms worth trading with.