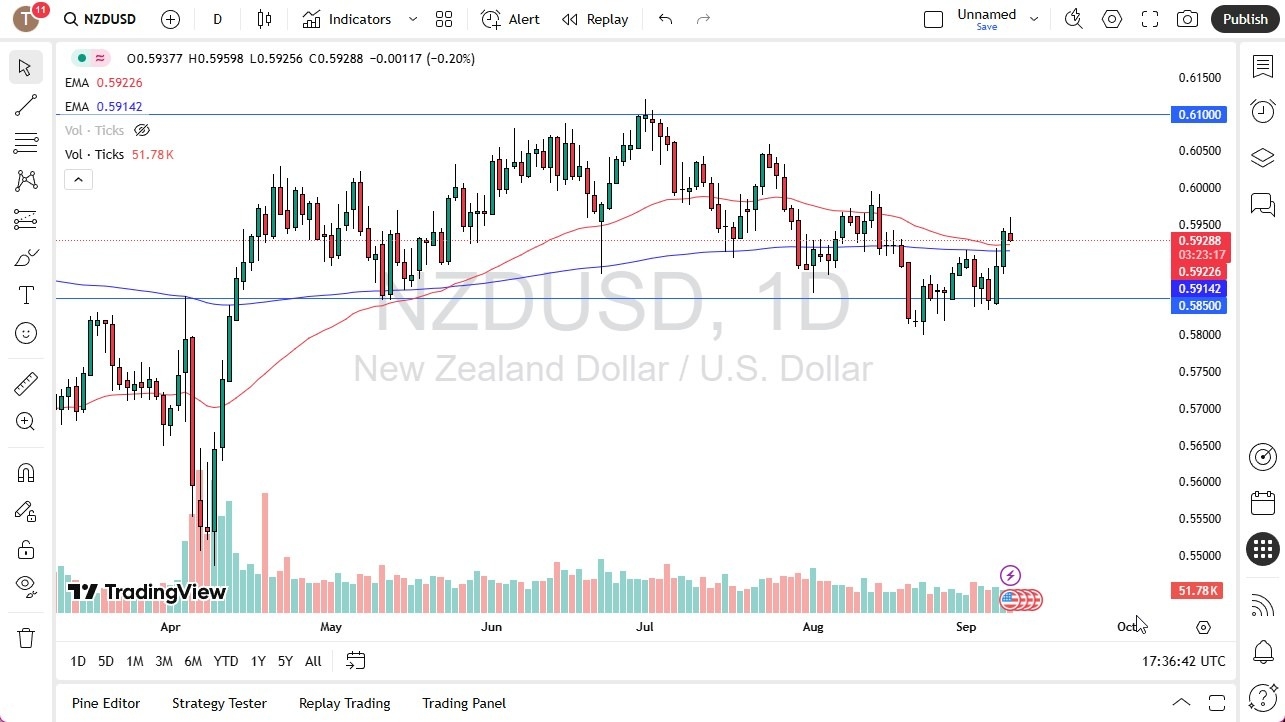

- The New Zealand dollar initially rally during the trading session on Tuesday, but struggled above the 0.5950 level, an area that probably extends all the way to the 0.60 level.

- All things being equal, this is a market that will continue to see a lot of noisy behavior, especially as the New Zealand dollar is so highly sensitive to Asia, and global economic movement.

Keep in mind that the RBNZ recently cut rates, and it is likely to see the New Zealand dollar fall as a result. After all, even though the Federal Reserve is anticipated to cut rates fairly soon, the reality is that if we do get a sudden “risk off” type of world out there, the New Zealand dollar is not the first place people are going to be running to. The US dollar of course is considered to be a safety currency, and therefore a lot of people will be looking for the US Treasury market in order to protect their wealth. Ultimately, this is a market that will be paying close attention to global trade, because of course New Zealand is highly sensitive to Chinese demand, and if global trade is starting to break down, that will be very weak.

Top Regulated Brokers

Technical Analysis

The technical analysis for this pair is a bit noisy at the moment, but it’s also worth noting that the 50 Day EMA is relatively flat, as well as the 200 Day EMA. The candlestick for the trading session on Tuesday suggests that we are going to close with a shooting star, which of course is a very negative sign as well. I think at this point, markets could very well go looking at the support level at the 0.5850 level. On the other hand, the market were to break above the 0.60 level, then it opens up the possibility of a move to the 0.61 level.

Ultimately, this is a market that will remain noisy, but it is very difficult to get excited about the New Zealand dollar, especially as we are starting to see the US dollar strengthen against many other currencies at the moment.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.