USD/CHF

The US dollar rallied initially during the previous trading week, but we have formed a longtail to the upside again for the 3rd week in a row. Ultimately, this is a market that looks as if it is going to do everything it can to drop down toward the 0.79 level. Whether or not we can hold onto the 0.79 level remains to be seen, but it does make a certain amount of sense that the Swiss franc continues to strengthen, mainly due to the fact that there is so much negativity out there when it comes to economic growth. I believe that rallies will probably continue to be sold into.

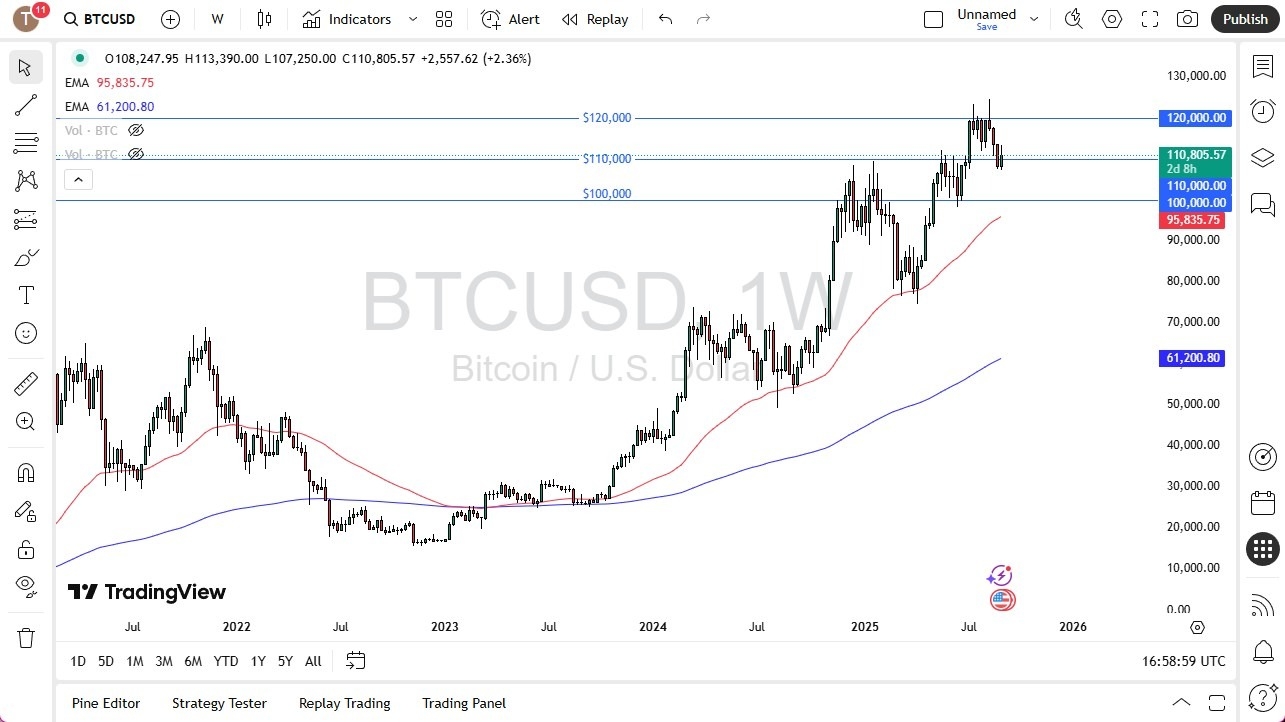

BTC/USD

Bitcoin has finish the week with a green candlestick, but quite frankly the Friday candlestick is a bit ugly. The $110,000 level is an area of interest, and of course we are trying to do what we can to hang on to the previous resistance barrier as support. If we break down below the bottom of the candlestick for the week, it’s possible that Bitcoin could drop down to the $100,000 level. That being said, keep in mind that Bitcoin is highly sensitive to risk appetite, so if we continue to see more fear in the markets, Bitcoin will not do well.

Gold

Gold rallied very significantly over the last week, because of the Non-Farm Payroll announcement that shocked the market. Quite frankly, we have blown through the $3500 level, and it looks like we are going to go much higher. Based on the “measured move”, it’s possible that the gold market might go looking to reach the $3800 level. The size of the candlestick is very impressive, and any pullback at this point in time should see a lot of support near the $3500 level.

Top Regulated Brokers

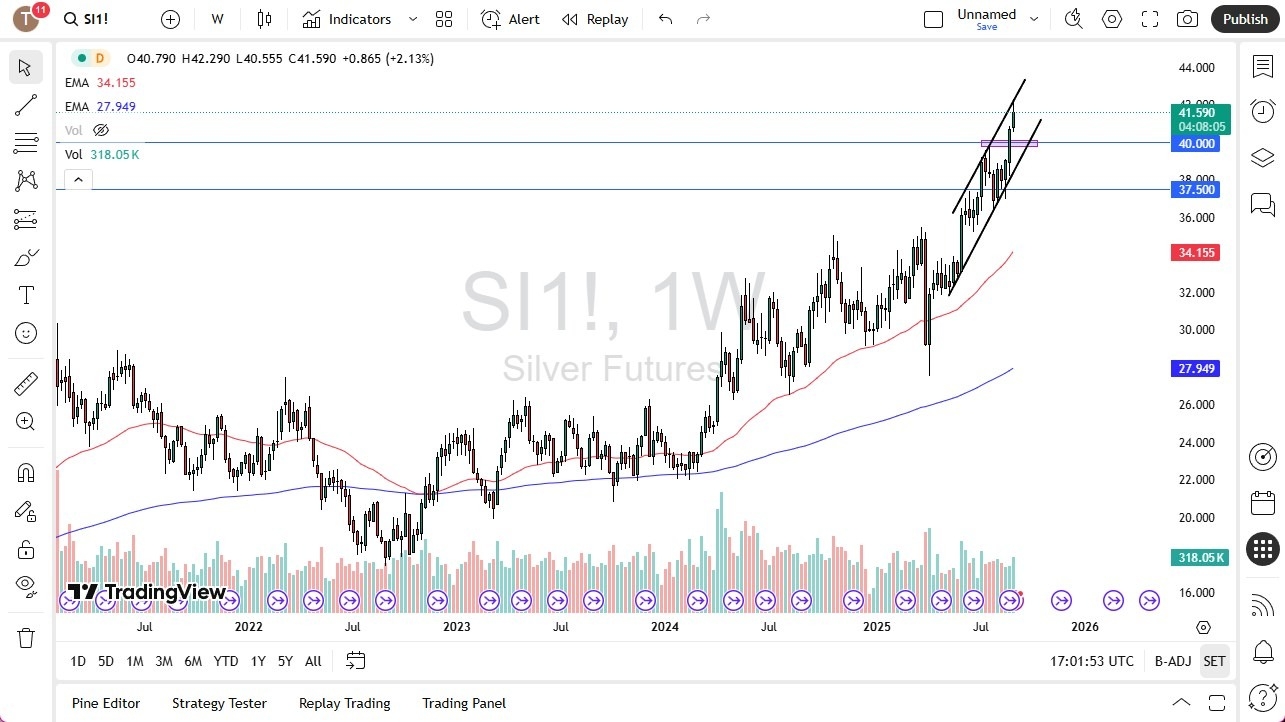

Silver

Silver rallied rather significantly during the course of the trading week, to test the crucial $42 level. We are a little overbought at this point, but it looks like the US dollar might take a bit of a beating in the short term, and if that ends up being the case, silver very well could be a big victor. Pullbacks at this point in time should look at the $40 level underneath as significant support, so therefore it’ll be interesting to see whether or not it holds. If we continue to go higher and break above the $42 level, then we could get an impulsive move higher.

EUR/USD

The euro fell during the course of the trading week to test the 1.16 level. However, the jobs number was so poor the United States we did see a shot to the upside, and it looks as if traders are trying to do everything they can to rally at this point. That being said, we are still very much in the same consolidation area that we had been in previously, so if we were to break down below the 1.16 level after this jobs number, it would be an extraordinarily negative turn of events. If we break above the 1.18 level, then we could go looking to the 1.20 level.

GBP/USD

The British pound looked as if it was in serious trouble earlier in the week but has rallied quite significantly from underneath the crucial 1.34 level. The resulting hammer is a good sign for the British pound, perhaps trying to get back to the 1.36 level. If we can break above the 1.36 level, then the market could go looking at the 1.38 level after that. Short-term pullbacks could end up being buying opportunities, but if we break down below the low of the previous week at 1.3350, then the British pound could find itself in further trouble in more of a “risk off” type of scenario.

NASDAQ 100

NASDAQ 100 has been all over the place during the week as you would expect, due to the fact that there have been so many different things going on this past week. The jobs number of course was the biggest driver of where we went, but it looks as if we are still very much on the same up trending channel that we had been in previously. If we can break above the 24,000 level, then it’s likely that the NASDAQ 100 could really start to take off. On the other hand, if we were to break down below the 23,500 level, that could be a very negative turn of events for NASDAQ.

USD/MXN

The US dollar has been very noisy against the Mexican peso, as the market is trying to figure out what’s going on with the US economy. With the jobs numbers coming out as week as they did, that could cause some issues for the Mexican economy as they are the biggest exporter to the United States and the world. In other words, if the US economy starts to crumble, that is a major problem for the Mexican economy. However, if we were to break down below the 18.50 level, then I think we could go to the 18.00 level. Rallies at this point in time would need to break above the 200 Day EMA near the 19.0449 level to get me remotely bullish.

Ready to trade our Forex weekly forecast? We’ve made a list of some of the best regulated forex brokers to choose from.