- The S&P 500 initially reacted positively to the idea that the US economy only gained 22,000 jobs for the month of August, instead of the expected 75,000.

- Because of this, traders are starting to bet on the idea that perhaps there are some problems with the US economy.

- Initially, it looked like the stock market was going to celebrate the idea of loose monetary policy coming out of the Federal Reserve due to the weakness in the job market.

- However, it looks as if traders have found other ways to look at this, which is quite typical once you start to see serious problems with the US economy.

What does this mean?

Top Regulated Brokers

Traders start to think about the idea of what this actually means, mainly due to the fact that if the Federal Reserve is starting to cut interest rates, they must certainly see something ugly out there, which could cause some problems for various companies. Sooner or later, Wall Street starts to think about the real economy, and that might be part of what we are seeing on Friday. The question of course is how long is it going to be before they start to think about the idea that the ultra-loose monetary policy by be a sugar rush?

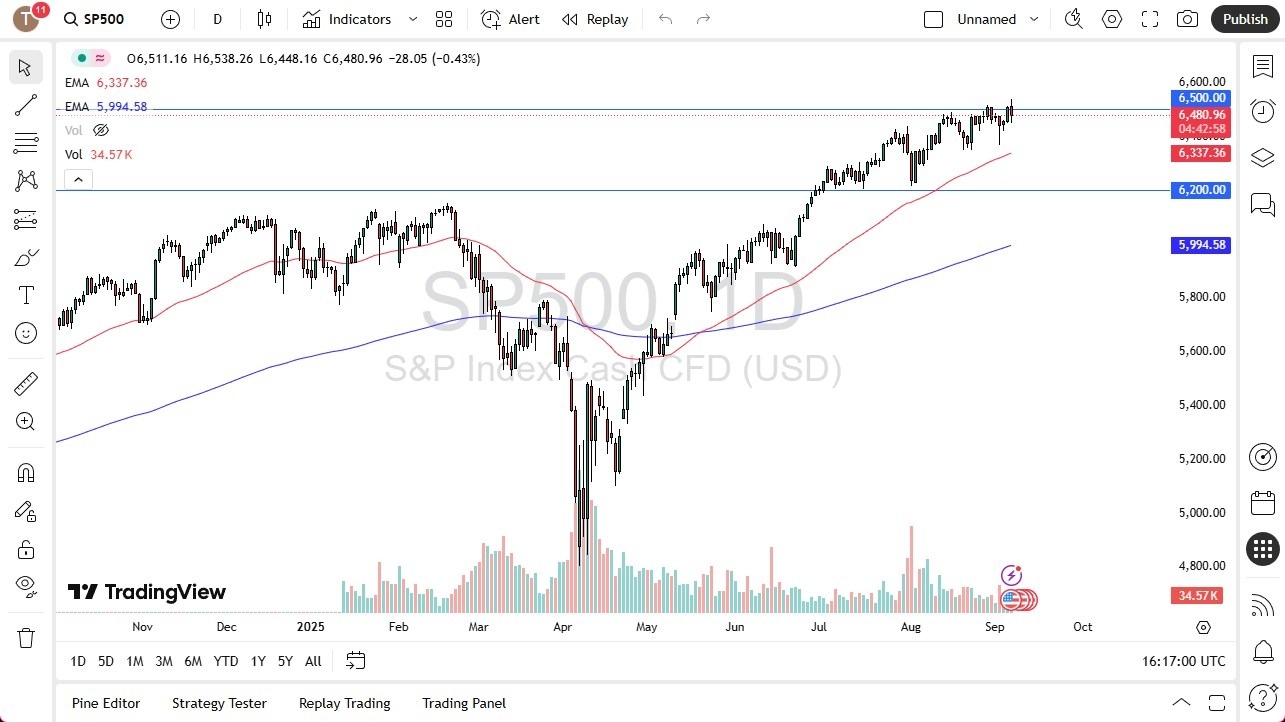

That being said, it’s quite common to see the market pull back rather drastically and do a bit of a dive as traders start to worry about the overall growth situation. That being said, there are plenty of areas in the short term that might offer a place for a bit of a bounce. The 50 Day EMA sits at the 6336 level, followed by the 6200 level. Ultimately, the stock market probably needs a bit of a pullback anyway, so this just might be the excuse to start selling.

I do believe that there is a selloff coming in Q3, and this could be the first “shot across the bow.” Whether or not things actually stay this way remains to be seen, and I think the Monday candlestick will be crucial as to where we go for the next couple of weeks.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.