Short Trade Idea

Enter your short position between $87.18 (yesterday’s intra-day low) and $89.99 (yesterday’s intra-day high).

Market Index Analysis

- Starbucks (SBUX) is a member of the NASDAQ 100, the S&P 100, and the S&P 500 indices.

- All three indices move away from all-time highs, as bearish pressures dominate.

- The Bull Bear Power Indicator of the S&P 500 turned bearish.

Market Sentiment Analysis

Yesterday’s late-session recovery from the lows received a boost from a favorable antitrust ruling against Google parent Alphabet, which stated it does not have to sell and divest its Chrome browser unit. Countering bullish sentiment is a report suggesting US holiday spending will face the steepest drop since the COVID-19 pandemic. Uncertainty over tariffs persists, and President Trump vowed to keep them intact. Investors are likely to remain cautious until Friday’s NFP report. Futures are mixed, with the Dow Jones down by nearly 200 points, while the NASDAQ is moderately up, with the S&P 500 flat.

Starbucks Fundamental Analysis

Starbucks is the world’s largest coffeehouse chain. Many credit it with launching the second wave of the global coffee culture. The company serves customers in 80 countries from over 35,700 stores.

So, why am I bearish on SBUX while institutional investors remain bullish?

Contracting profit margins, negative earnings per share growth, and balance sheet issues plague Starbucks. Competition from China, a trend in its infancy, and rising input costs also apply downside pressure on SBUX. High inflation and a decrease in discretionary spending power could alienate many consumers, as SBUX tries to attract high-end spenders, while it remains vulnerable to consumer downgrades. Its valuation remains too high, and I expect a course correction.

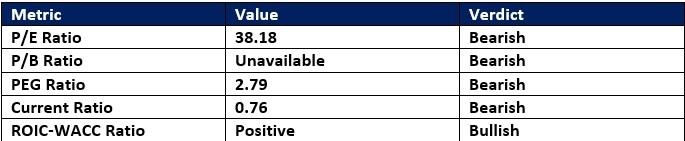

Starbucks Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 38.18 makes SBUX an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.81.

The average analyst price target for SBUX is 99.38, which suggests moderate upside potential, but downside risks prevail.

Starbucks Technical Analysis

Today’s SBUX Signal

- The SBUX D1 chart shows a price action inside a bearish price channel.

- It also shows price action challenging between its ascending 50.0% and 61.8% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with a descending trendline.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- SBUX corrected more than the S&P 500, a bearish trading signal.

My Call on Starbucks

Top Regulated Brokers

I am taking a short position in SBUX between $87.18 and $89.99. While Starbucks attempts to sign new partnerships in China, I believe it will lose out to domestic coffee houses and tea chains. Valuations are high, and the decline in profit margins and earnings per share provides a bearish outlook. Rising costs plague SBUX, which should resume its march lower in September.

- SBUX Entry Level: Between $87.18 and $89.99

- SBUX Take Profit: Between $71.55 and $75.50

- SBUX Stop Loss: Between $94.85 and $98.89

- Risk/Reward Ratio: 2.04

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.