Momentum investing remains an underappreciated strategy; however, a study at the Cambridge Judge Business School found that stocks that outperformed the S&P 500 in the previous twelve months are likely to continue outperforming by an average of 17.5% in the next twelve-month period.

What are Momentum Stocks?

Momentum stocks refer to publicly listed companies that have a significant catalyst, bullish or bearish, driving share prices higher. Cyclicality, secular growth, and corporate events such as earnings releases, mergers and acquisitions, and technical or medicinal breakthroughs are core drivers of momentum stocks. Momentum investors also rely on technical momentum indicators, such as the Relative Strength Index (RSI) and the Moving Average Convergence/Divergence (MACD) indicators. This technical definition is the most popular.

Why Should You Consider Investing in Momentum Stocks?

Market conditions change, and successful investors and traders know when to apply which strategy to ensure maximum returns with minimal risk. Buying momentum stocks can improve returns if investors understand what to look for.

Here are a few things to consider when evaluating momentum stocks:

- Focus on momentum stocks that have outperformed the S&P 500 over the past twelve months.

- Invest in momentum stocks that are in an upward cycle or that experience secular growth.

- Analyze momentum stocks in trending industries where they have a disruptive impact.

- Use technical indicators like the MACD or the RSI to fine-tune your entry points.

- Keep up to date with the data and news flow to make necessary adjustments and exits, as momentum can swing swiftly.

What are the Downsides of Momentum Stocks?

Momentum stocks can swiftly lose their momentum and reverse direction. It requires an active approach, which is time-consuming and not ideal for most retail investors. Momentum investors must also brace for volatility and differentiate between momentum-keeping short-term events and momentum-changing developments.

Here is a shortlist of attractive momentum stocks:

Pagaya Technologies (PGY)

Futu Holdings (FUTU)

Grail (GRAL)

Mitsubishi UFJ Financial (MUFG)

Vertiv Holdings (VRT)

Hims & Hers Health (HIMS)

InterDigital (IDCC)

Super Micro Computer (SMCI)

TriMas Corporation (TRS)

Tempus AI (TEM)

Futu Holdings Fundamental Analysis

Futu Holdings (FUTU) is a leading tech-driven digitalized brokerage and wealth management platform. It operates globally, including via its subsidiary Moomoo in the US. Tencent remains one of its largest shareholders.

So, why am I still bullish on FUTU after a 125%+ rally since April?

Futu Holdings is the largest tech broker in Hong Kong. It reported record growth in revenues and net income. Its profit margins rank among the best in the industry, and trading demand from China can continue its momentum. FUTU also maintains an excellent earning per share growth rate, and I see more upside in the years ahead, assisted by its international expansion. Its US crypto launch could also provide a massive revenue and income boost.

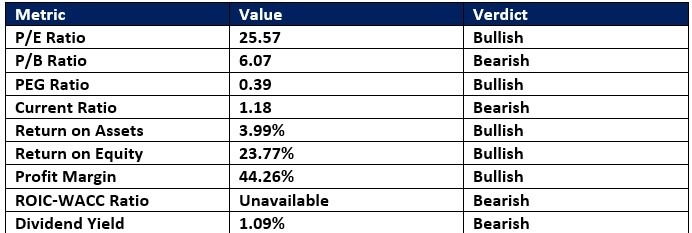

Futu Holdings Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 25.57 makes FUTU an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 30.01.

The average analyst price target for FUTU is 205.10. It suggests double-digit upside potential with limited downside risks.

Futu Holdings Technical Analysis

Futu Holdings Price Chart

- The FUTU D1 chart shows price action trading between its ascending 0.0% and 38.2% Fibonacci Retracement Fan.

- It also shows Futu Holdings inside of a bullish price channel.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

My Call on Futu Holdings

I am taking a long position in FUTU between 177.51 and 191.60. This momentum stock remains reasonably valued despite its massive 125%+ rally since April. The PEG ratio suggests plenty of upside potential, and its profit margins rank among the best in the industry. It should generate sufficient free cash flow to expand its operations.

Vertiv Holdings Fundamental Analysis

Vertiv Holdings (VRT) manufactures and provides critical infrastructure and services for data centers, communication networks, and commercial and industrial environments. Active in over 40 countries, with regional headquarters in Switzerland, China, Singapore, Australia, and India. VRT maintains 24 manufacturing and assembly facilities and employs over 30,000. Vertiv Holdings is also a member of the Russell 1000 Index.

So, why am I bullish on Vertiv Holdings despite a loss of momentum?

Vertiv Holdings rides the AI wave to fresh records, and despite its temporary momentum loss, it has superb fundamentals to power ahead for another leg higher. Its PEG ratio points towards unlocked value. Current valuations are high, but reasonable for an AI-related momentum stock. It also invests 5% of revenue in research and development. VRT has roughly 3,000 registered patents and 1,800 registered trademarks.

Vertiv Holdings Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 61.04 makes VRT an inexpensive stock. By comparison, the P/E ratio for the Russell 1000 Index is 63.42.

The average analyst price target for Vertiv Holdings is 157.42. It suggests excellent upside potential from current levels.

Vertiv Holdings Technical Analysis

Vertiv Holdings Price Chart

- The VRT D1 chart shows price action between its ascending 38.2% and 50.0% Fibonacci Retracement Fan following a double breakout.

- It also shows Vertiv Holdings inside its horizontal support zone.

- The Bull Bear Power Indicator is bearish with an ascending trendline.

My Call on Vertiv Holdings

I am taking a long position in Vertiv Holdings between 121.41 and 134.93. VRT has excellent, double-digit organic growth rates, and the PEG ratio suggests more gains ahead. It also has a robust backlog of over $8.5 billion, and VRT benefits from a diverse customer base. I rank it among the best data center plays.

Ready to trade the best momentum stocks? Take a look at our list of the best stock brokers