Real estate has always been an exciting long-term investment, and it should be part of a well-diversified portfolio. Real estate investments can provide an inflation hedge, a steady income stream, and superb growth opportunities.

What are Real Estate Stocks?

Real estate stocks refer to publicly listed companies that are active in the real estate sector. The most efficient method of investing in real estate stocks is via REITs, but investors can also pick individual stocks to gain exposure to the vibrant real estate market. Investing in REITs is like investing in ETFs, as various REITs maintain their unique mix of real estate portfolios. Other real estate stocks provide management and development services without owning property.

Why Should You Consider Investing in Real Estate Stocks?

Real estate stocks offer outstanding portfolio diversification. The real estate sector has limited correlation to the stock market. Still, over 50% of US households invest in the stock market. Real estate provides a wealth effect, meaning rising home values can lead to more stock investments. Also, REITs pay at least 90% of their earnings to shareholders via dividends.

Real estate stocks and REITs are neither better nor worse than equity investments. They are just an intelligent diversification method. So, real estate investors may have to be more active and rebalance their holdings.

Here is an example:

- The three-year and five-year returns for the S&P 500 were 15.01% and 15.66%, respectively (measured from June 4th, 2025).

- The three-year and five-year returns for the FTSE NAREIT All Equity REITs Index were 2.70% and 41.30%, respectively (measured from June 4th, 2025)

Here are a few things to consider when evaluating real estate stocks:

- Diversify your real estate portfolio with a mix of REITs that maintain various portfolio preferences.

- Avoid highly indebted real estate companies and REITs.

- Data center, healthcare, and warehouse real estate stocks and REITs should be part of each real estate portfolio.

What are the Downsides of Real Estate Stocks?

Interest rates can impact mortgage rates, which influence real estate stocks. Supply and demand are core drivers of property values, and the real estate sector ranks among the most vulnerable to financial troubles. Real estate investors should apply a long-term approach and understand how to handle volatility.

Here is a shortlist of attractive real estate stocks:

NNN REIT (NNN)

Prologis (PLD)

Park Hotels & Resorts (PK)

Kilroy Realty (KRC)

Federal Realty (FRT)

Welltower (WELL)

Host Hotels & Resorts (HST)

Invitation Homes (INVH)

Equinix (EQIX)

Empire State Realty (ESRT)

Realty Income (O)

Public Storage (PSA)

Prologis Fundamental Analysis

Prologis (PLD) is the world’s largest industrial real estate company. It manages 15,000 acres of land, totaling approximately 1.3 billion square feet, across 20 countries, with over 6,000 buildings in North America, Latin America, Europe, and Asia. PLD is also a member of theS&P 500 Index.

So, why am I bullish on PLD after its breakout?

I appreciate Prologis’ strategy of acquiring warehouses situated near major urban areas, where land is scarce. PLD focuses on keeping properties to the highest standards, which results in prime rent prices. Prologis has increased its dividend for eleven consecutive years, which includes double-digit profit and dividend growth over the past five years. I also like its recent focus on e-commerce and data centers, and its profit margins rank among the best in the industry.

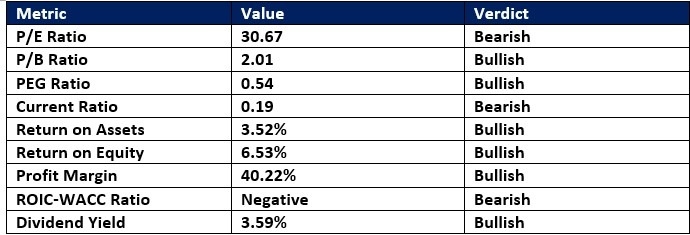

Prologis Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 30.67 makes PLD an expensive stock. By comparison, the P/E ratio for the S&P 500 is 30.01.

The average analyst price target for PLD is 119.95. It suggests limited upside potential with manageable downside risks.

Prologis Technical Analysis

Prologia Price Chart

- The PLD D1 chart shows price action trading between its ascending 0.0% and 38.2% Fibonacci Retracement Fan.

- It also shows Prologis entering its horizontal resistance zone with increased momentum.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

My Call on Prologia

I am taking a long position in PLD between 112.19 and 114.50. I believe the current momentum and the prospects for an interest rate cut could yield a breakout. The PEG ratio suggests more upside ahead, and the focus on e-commerce and data centers should extend its streak of dividend increases.

Public Storage Fundamental Analysis

Public Storage (PSA) is the world’s largest owner-operator of self-storage facilities. It has over 3,400 properties in the US and Europe with an aggregate of 221 million net rentable square feet of space. PSA also provides insurance services for tenants and manages 307 self-storage facilities for other owners. Public Storage is also a member of the S&P 500.

So, why am I bullish on Public Storage after its recent earnings disappointment?

I like its abandoned takeover bid for Australia’s Abacus Storage. PSA deploys a responsible dividend strategy and ranks among the best in its industry for returns on assets, equity, and invested capital. It also has an excellent profit margin, which should drive its excellent expansion strategy. The management’s expertise in acquisition and development amid the fragmented self-storage sector should drive future growth.

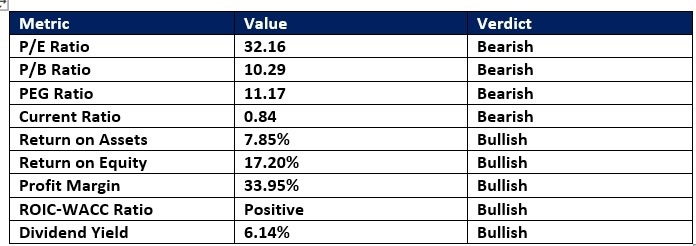

Public Storage Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 32.16 makes PSA an expensive stock. By comparison, the P/E ratio for the S&P 500 is 30.01.

The average analyst price target for Public Storage is 323.11. It suggests moderate upside potential from current levels.

Public Storage Technical Analysis

Public Storage Price Chart

- The PSA D1 chart shows price action between its ascending 38.2% and 50.0% Fibonacci Retracement Fan.

- It also shows Public Storage inside a bullish price channel.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

My Call on Public Storage

I am taking a long position in Public Storage between 289.15 and 296.47. PSA is an excellent dividend play, with a yield above 6.00% and a responsible dividend strategy. As the leader in self-storage and with a super management team, I see more upside for PSA.

Ready to trade the best real estate stocks? Take a look at our list of the best stock brokers.