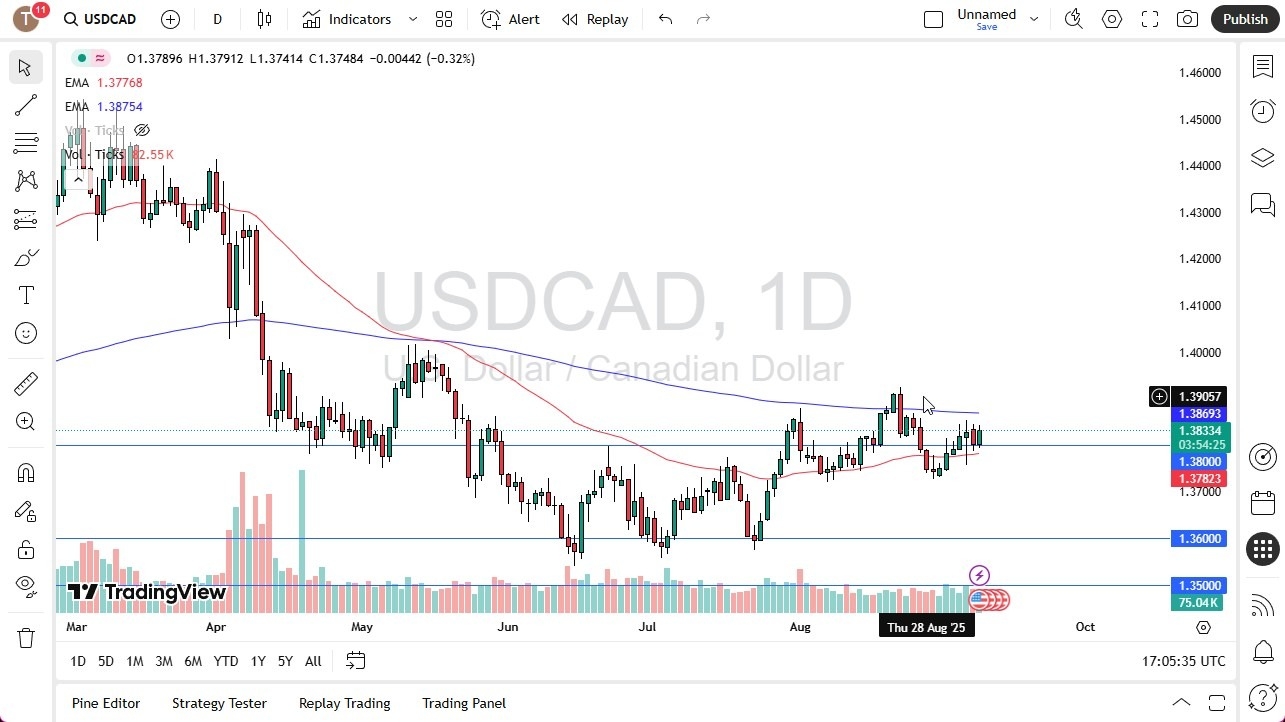

Potential signal:

- I am a buyer of this pair above the 200 Day EMA, currently at the 1.3871 level, with a stop loss at 1.3785 below.

- I would be aiming for a move to the 1.4025 level.

The US dollar rallied during trading on Tuesday, as the market continues to pay close attention to the 1.38 level, which has been like a magnet for price for some time. We are currently trading between the 50 Day EMA and the 200 Day EMA indicators. This suggests that market participants are essentially “flat” in their analysis, and the money that they are willing to put into the market. However, this is a market that I think will be making a bigger move soon, probably after we get away from the FOMC Meeting on September 17.

Top Regulated Brokers

Divergent Economies?

While the US jobs number was very poor on last Friday, adding just 20,000 jobs for the month of September instead of the expected 75,000, Canada actually lost 65,000 jobs. In other words, the Canadian economy seems to be struggling in a much sharper manner than the American economy, plus we also have to keep in mind that the Canadian economy gets 25% of its GDP from exporting to the United States. If the United States starts to slow down in any way whatsoever, in addition to everything that’s going on with the tariff spat, it’s going to be difficult for Canada.

Ultimately, this is a market that I think is going to be very noisy, but I also recognize that the interest rate differential continues to favor the US dollar, and of course the “safety trade” is very pro-US dollar at the same time. In other words, this is an environment where I think it’s difficult for the Canadian dollar to strengthen. Beyond all of that, you also have the oil market that looks somewhat sluggish, and even if it did rally significantly, it’s difficult to imagine a situation where the United States, currently producing 12.5 million barrels of oil a day, suddenly becomes less attractive because of this situation. All things being equal, I fully anticipate there will be a breakout to the upside, but we may have some time before that happens.

Ready to trade our USD/CAD daily analysis and forecasts? Here's a list of the best Forex Trading platform in Canada to choose from.