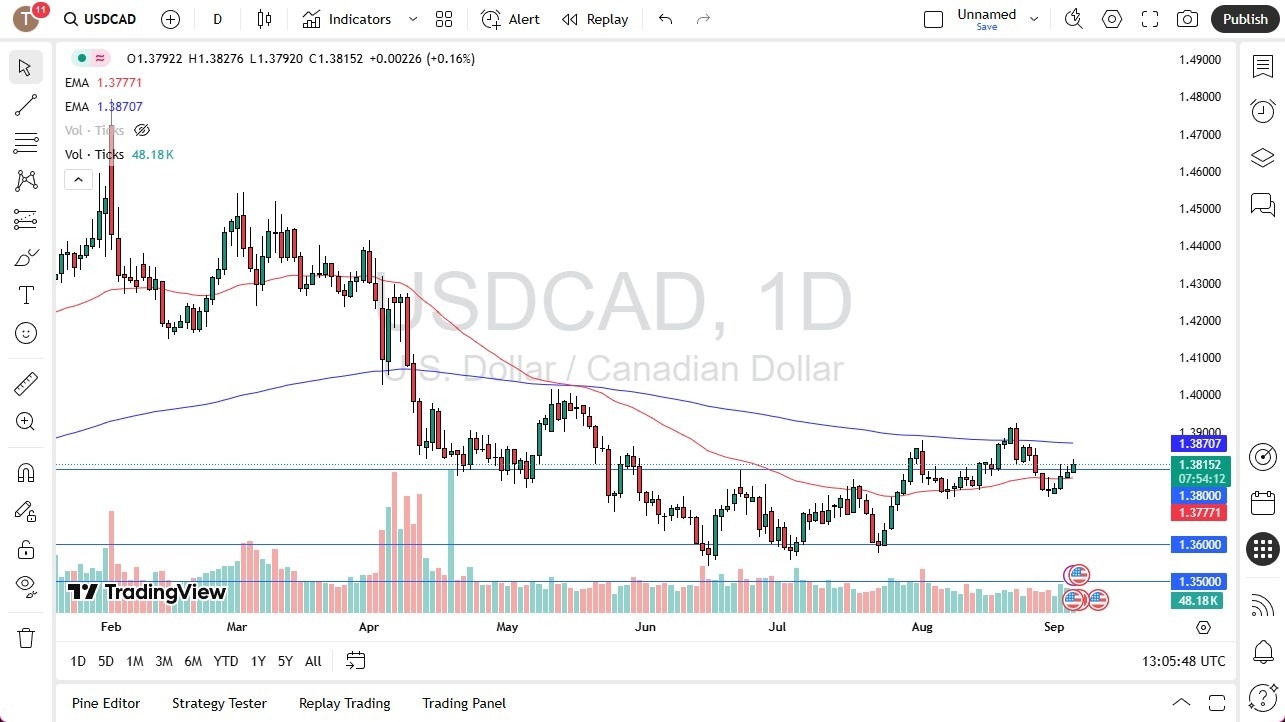

Potential signal:

- On Friday, if we break above the 1.3870 level, I am a buyer with a stop loss at the 1.38 level, and a target of 1.41 above.

The US dollar has risen a bit during the trading session here on Thursday against the Canadian dollar. We are breaking above the 1.38 level which I think is telling as we are between the 50 day EMA and the 200 day EMA also as we head towards the all-important Friday session. Friday has the employment numbers coming out of the United States and Canada simultaneously and Friday, will be the epicenter of what we find out about both economies. With that being the case, we are in a little bit of a holding pattern that does make quite a bit of sense. But if we continue to see the overall pattern continue to play out, we are in the bottoming pattern.

If We Break Higher

Top Regulated Brokers

If we can take out the 200 day EMA to the upside at 1.3870, then 1.39 gets targeted, followed by 1.40, et cetera. Any short-term pullback, I think, opens up the possibility of value hunting, but we will have to see how Friday plays out. Friday could change the entire narrative, we just don't know. I do see a massive amount of support at the 1.36 level, extending all the way down to the 1.35 level, where I think you have a major point of contention. Anything below there, I think the US dollar is in trouble, not only against the Canadian dollar, but probably multiple other currencies as well.

That being said, if the economy is starting to slow down in the United States and globally, Canada is not the place you want to be. So that should drive the value of the US dollar higher. Again, by the end of the day on Friday, we should have quite a bit more information, but right now we are in a holding pattern in what looks to be an attempt for the US dollar to gain ground yet again.

Ready to trade our USD/CAD daily analysis and forecasts? Here's a list of the best Forex Trading platform in Canada to choose from.