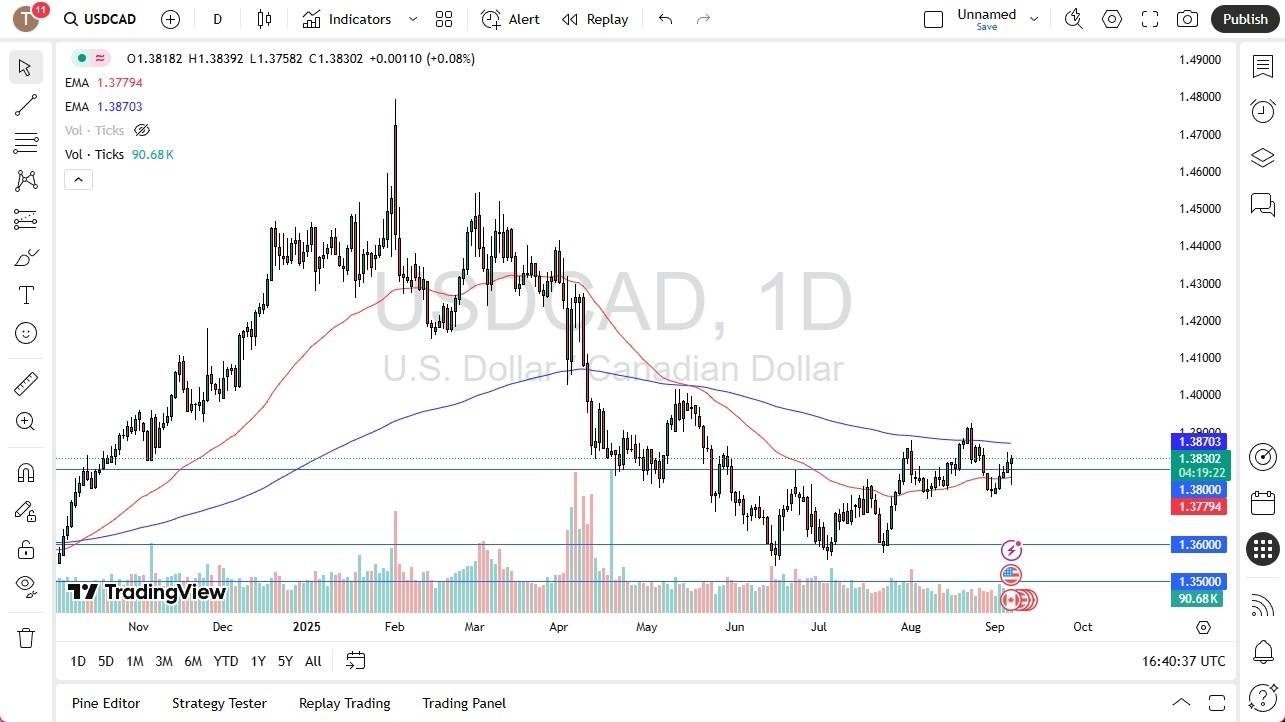

Potential signal:

- On a move above 1.3880, I’m a buyer of this pair, with a stop loss at 1.3790, and a target of 1.41.

The USD/CAD pair has been a wild ride during the trading session on Monday, as we have seen employment numbers coming out of both the United States and Canada, one would be anticipating quite a bit of volatility and what would be “Ground Zero” in the currency markets.

Top Regulated Brokers

The Canadians printed a -65,500 jobs for the month of August, instead of the expected 4900 jobs added. The unemployment rate is now 7.1% in Canada, while the Americans added jobs, it was only 22,000 added. They were expected to add 75,000 jobs, and the unemployment rate is now at 4.3%. All things being equal, the Canadians had a much bigger mess on their hands than the Americans did, although at the end of the day, it also makes sense that the US dollar would do better, because quite frankly, without the US economy, Canada doesn’t have one.

Technical Analysis

The technical analysis for this market is somewhat sideways at the moment, because we are halfway between the 50 Day EMA below, and the 200 Day EMA above if we can break above the 200 Day EMA, then this market could go looking to the 1.40 level, possibly even higher than that. On the downside, if we were to break down below the 1.37 level, then we could open up the possibility of a move down to the 1.36 level. There is a massive amount of support between 1.36 and 1.35, and I consider that to be a massive “zone of support.”

Keep in mind that the Canadian dollar does not get a boost from crude oil, not that crude oil is particularly strong at the moment, against the US dollar. The Americans produce 12.5 million barrels of crude oil a day, so that ship has sailed as far as correlation is concerned. If the US dollar starts to get a bit of a bid, and it very well could be due to the fact that there will be a lot of concerns out there now, the Canadian dollar will continue to lose ground.

Ready to trade our Forex USD/CAD predictions? Here are the best Canadian online brokers to start trading with.