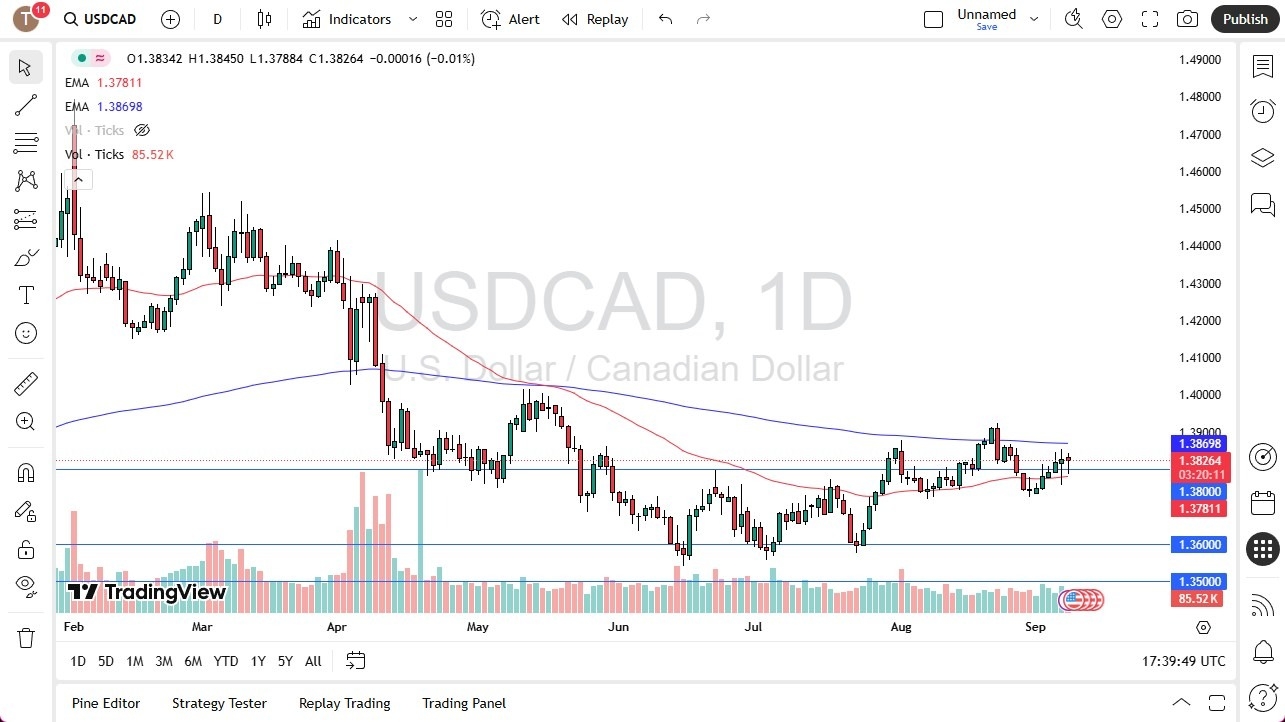

Potential signal:

- I am a buyer of this pair if it breaks above the 200 Day EMA.

- I would have a stop loss of 60 pips, and a target of 1.40 at that point.

We've been all over the place during the early hours on Monday in the US dollar against the Canadian dollar, but the one thing that I would point out is that we have seen a continuation of buyers on dips that started on Friday. This does make a lot of sense because despite the fact that the United States jobs number was ugly, it was not negative. Canada printed a negative 65,500 jobs for the month of August. In other words, Canada is really starting to feel the pinch. So, this is a situation where if there is a risk off type of move, it typically will send money into the US dollar away from Canada. After all, US treasuries are considered to be the safest of assets pretty much. And as a result, money will flow away from Canada or even out of Canada into the Treasury market.

Technical Analysis

The 200 day EMA sits at the 1.3869 level and is squeezing a little lower. But we also have the 50 day EMA sitting underneath. I think at this point, the weakness of the Canadian economy and maybe even the weakness of the US economy might be reason enough to go long here.

Top Regulated Brokers

The interest rate differential favors the United States, and it is probably worth noting here that we have been forming something that I guess I could consider a rounded bottom. We'll just have to wait and see how that plays out.

But so far, it certainly looks like we might get that if we do pull back from here. It's really not until we break down below the 1.35 level that I'd be interested in shorting this pair. Because even if the US dollar falls, Canada is not where money is going to end up flowing.

Ready to trade our Forex USD/CAD predictions? Here are the best Canadian online brokers to start trading with.