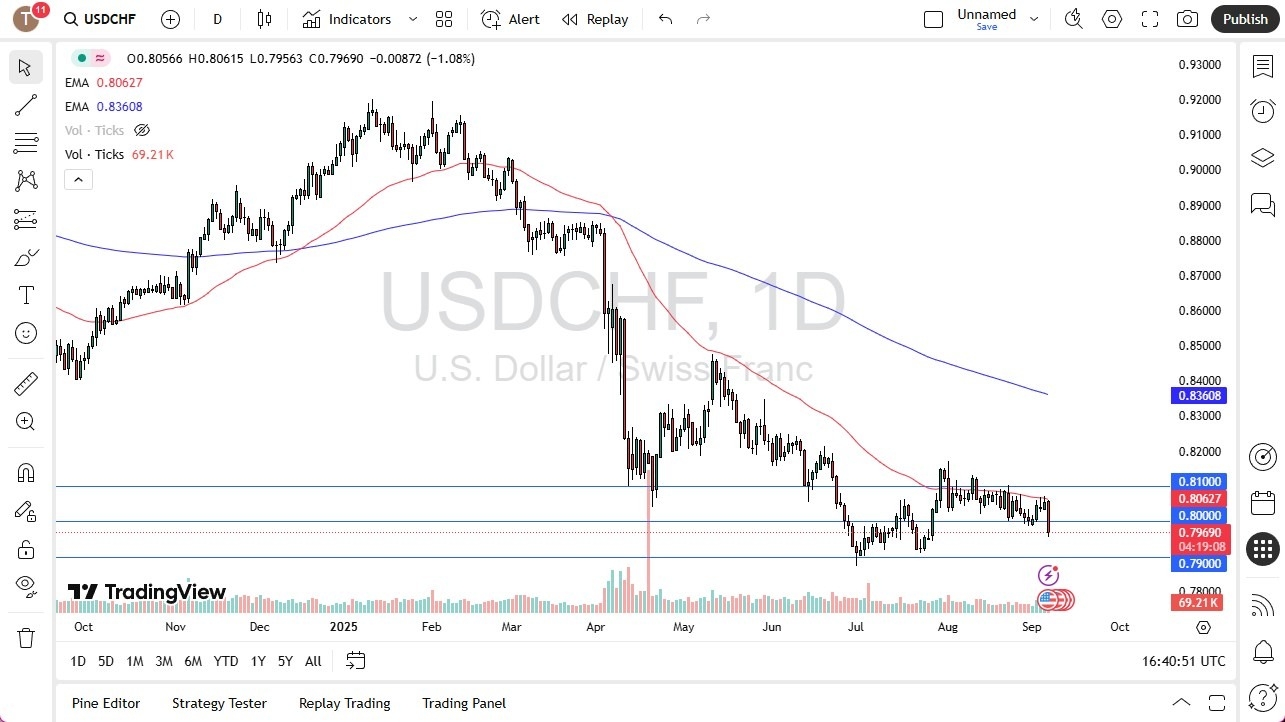

- The US dollar fell significantly during the trading session on Friday, as we broke below the crucial 0.80 level.

- The Non-Farm Payroll announcement was shocking, as the United States only added 22,000 jobs for the previous month, instead of the expected 75,000.

- The movement in this pair makes the most sense, because quite frankly if the United States is going to go into some type of recession, the Swiss franc would be a place a lot of traders might be looking at.

Technical Analysis

Top Regulated Brokers

The technical analysis for this pair is pretty poor, and it is probably worth noting that the Friday candlestick shows a little bit of conviction. While I don’t necessarily expect to see the US dollar fall apart against the Swiss franc, I think it’s going to be difficult for the US dollar to truly take off against the Swiss franc. Eventually, people will go running for safety, and while the US dollar might do fairly well against other currencies, this might be one of the outliers.

If we were to turn around and rally significantly, the 50 Day EMA above could be a significant barrier, followed by the 0.81 level. The 0.81 level is an area where we could see a little bit of resistance, but if we were to break above there, then the market will probably challenge the 0.82 level. I don’t necessarily see this happening, but you should always keep the “alternate scenario” in the back of your head.

Ultimately, I think the Swiss franc will probably start to gain against most currencies, and while the US dollar is particularly vulnerable at the moment, I think the downward pressure is probably somewhat limited here. After all, we could be looking at situations where the USD, CHF, and JPY currencies all attract a certain amount of attention. Ultimately, people could be looking for safety soon, and the Swiss franc is one of the few currencies that might be “safer” than the US dollar.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.