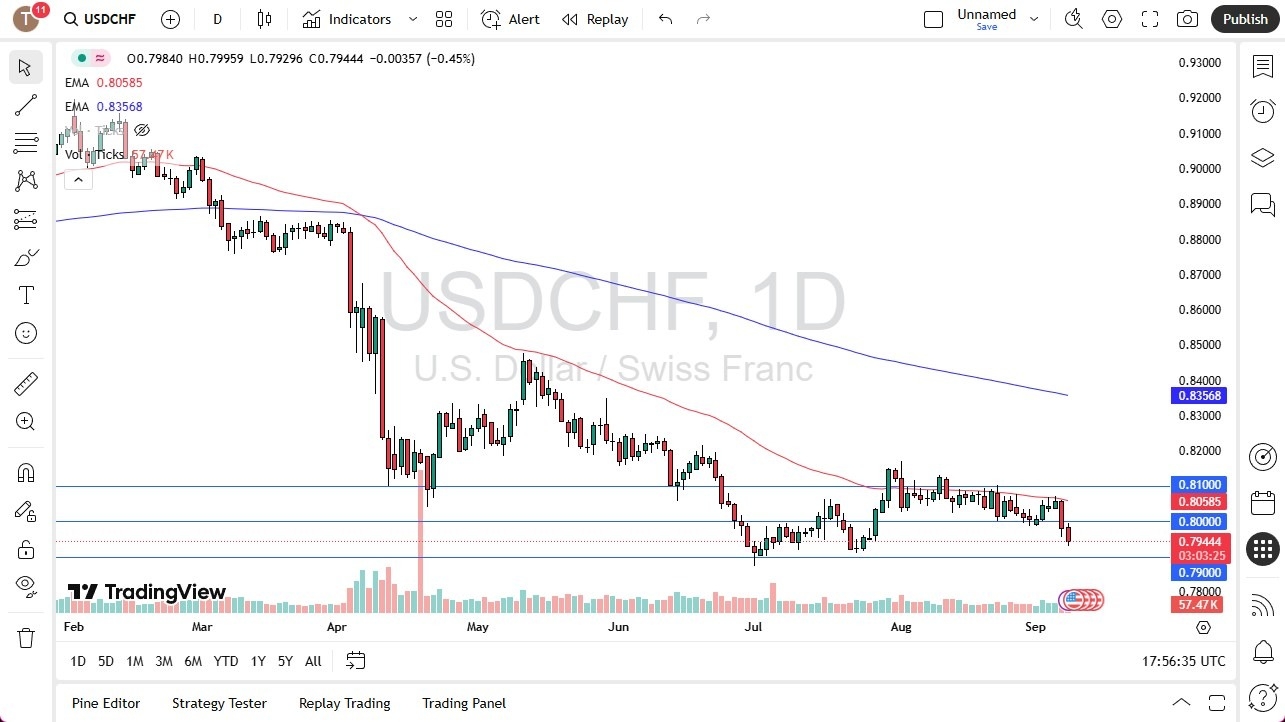

- The US dollar initially tried to rally just a bit during the early part of the trading session on Monday to reach toward the 0.80 level, only to roll over again.

- At this point, the market is likely to continue to see a lot of negative pressure on the US dollar against the Swiss franc, even if we have a major run to safety.

- While the US dollar is a significant safety currency, the reality is that the Swiss franc is even safer.

So, all things being equal, this is a market where I think short-term rallies continue to get squashed, and it could send the dollar down to 0.79 on the chart. And if we were to break 0.79, then I think the US dollar really starts to fall apart.

Top Regulated Brokers

On a Rally

If we rally from here, then market participants will be paying close attention to the 50 day EMA at the 0.8058 level and dropping. If we were to break above there, the 0.81 level is an area where we see a lot of resistance. Anything above that level then really starts to change the overall picture. But as things stand right now, this is a downtrend, and you have to follow it as such.

This might be a situation where the US dollar weakens against the Swiss franc and gains against everything else that would make a certain amount of sense. If we are starting to see traders worry about the overall global economy markets, things like that. So, over the longer term, that does tend to drive this lower.

If we break the 0.79 level, the Swiss won't like it, and they may intervene, but it won't be directly in this pair. You have to pay attention to what the euro is doing against the Swiss franc. That's actually what triggers their concern. So, if the euro is basically stable against the franc, then they probably will be okay with this. All things being equal though, this is a market that looks very negative, and I just don't think that change, at least not until we get above the 0.81 level at the very least.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.