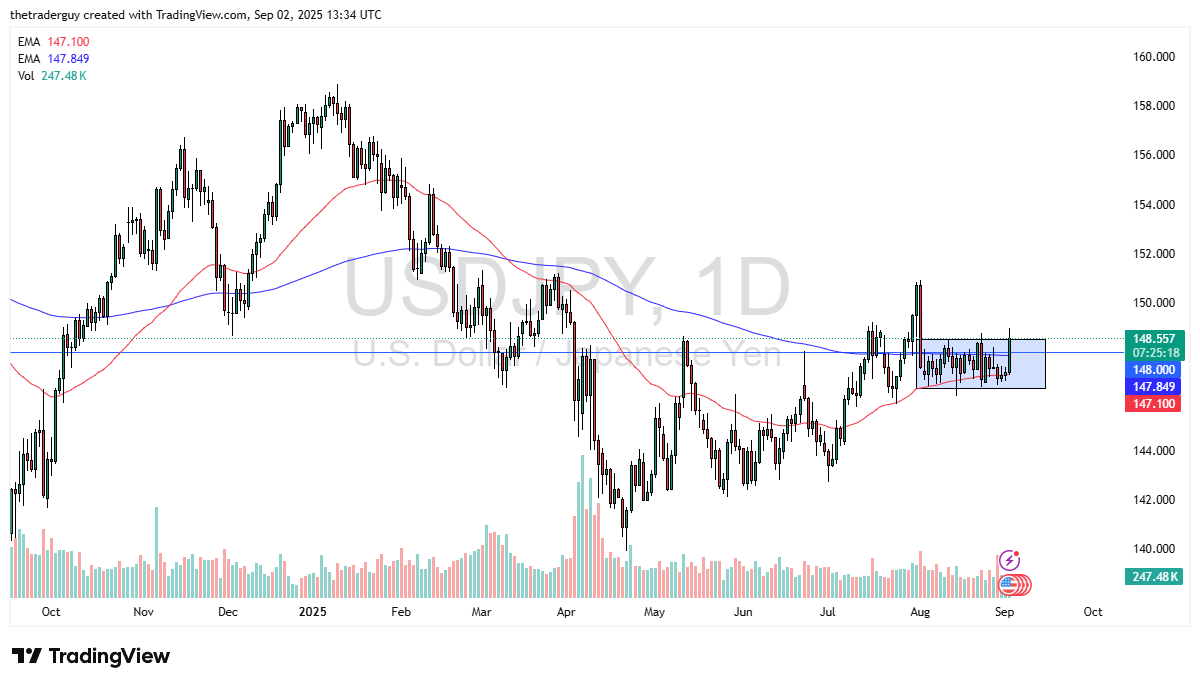

- The US dollar has rallied quite nicely against the Japanese yen in early trading on Tuesday as we are testing the crucial 148.5 yen level an area that has been a bit of a barrier for some time now.

- Ultimately, this is a market that if we can break above here, we could go looking to the 151 yen level but I think it's going to be a bit difficult to do it all in one shot, mainly due to the fact that we do get the employment numbers later in the week on Friday, and that will obviously have a major influence on what happens next with the US dollar and risk appetite in general.

- It's worth noting that we have broken above the 200-day EMA as well, so that's a good sign, but both moving averages, the 50-day EMA and the 200-day EMA, are flat at the moment. So that doesn't necessarily suggest that we are in any type of trend.

Choppy Week Ahead?

I anticipate that most of this week will probably be choppy and somewhat sideways as we wait for that important jobs figure. The real question at this point in time is will the interest rate differential continue to favor the US dollar over the longer term, which I think it will. And that does give a little bit of credence to the idea of a positive currency pair here.

Top Regulated Brokers

Whether or not we can really come to grips with that between now and the jobs number is a completely different situation. But I think you've got a scenario where traders will have to watch this.

Maybe more of a buy on the dip mentality is the way to go. That's the way I've been playing this pair for a couple of weeks now. After that nasty sell-off, and then we just went sideways. Sometimes it's all about where a pair won't go.

And at this point, it doesn't look like it wants to go lower. So, I remain bullish, but I also keep my expectations a little tempered over the next couple of days.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.