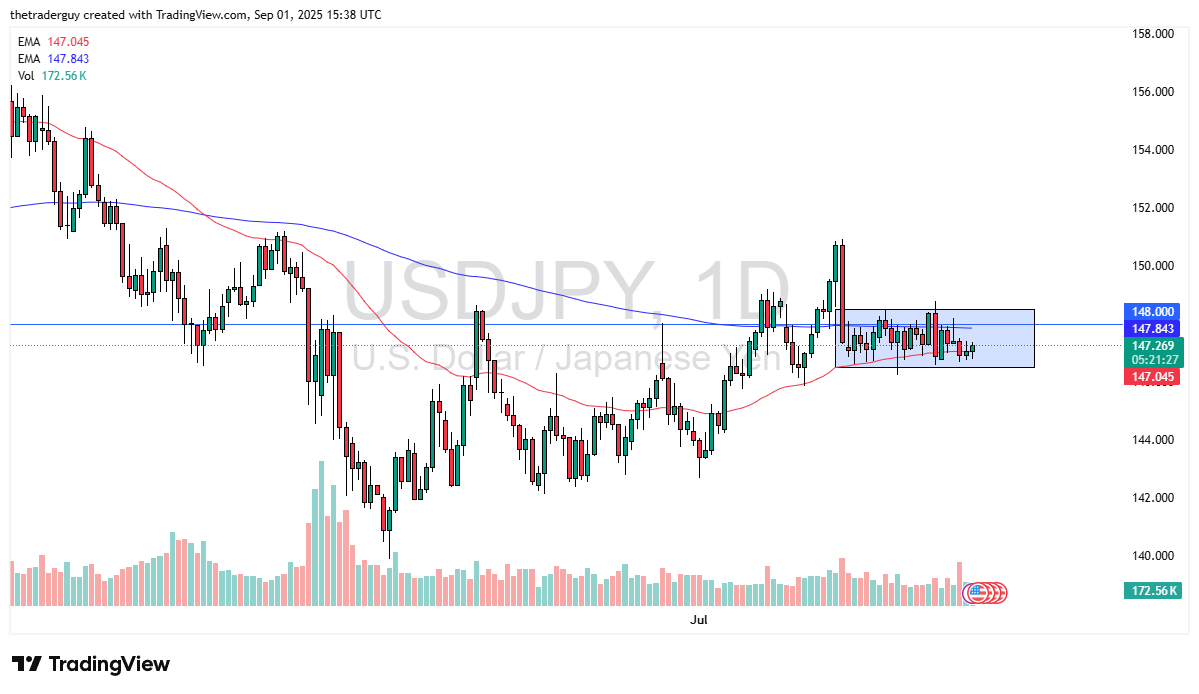

Potential signal:

- On a move above the ¥148.50 level, I’d be a buyer with a stop loss near the ¥147.50 level goodbye target would be ¥150.60 above.

The US dollar initially fell against the Japanese yen during the trading session on Monday, which of course was Labor Day in the United States.

This means volume was somewhat anemic during the North American trading session, so you should look at the daily candlestick as essentially a “12 hour candlestick.”

Top Regulated Brokers

Technical Analysis

What I find interesting about this pair is that over the last couple of weeks, we have seen the US dollar plunged against the Japanese yen, only to sit still afterwards. The longer this goes on, the more bullish the market will become, because quite frankly people are becoming very comfortable with this level. On August 1, it looks like the US dollar was going to fall out of bed. Since then, we really haven’t gone anywhere and therefore I think the market is still trying to sort some things out.

The 50 Day EMA sits right where we are, with the 200 Day EMA sitting just below the crucial ¥148 level. Ultimately, I think we are trading in a 200 pip range between ¥146.50, and ¥148.50 above. Ultimately, if we can break out of this range it opens up the next move, and currently it just looks like short-term range bound trading will continue to be the main way people approach this market.

Central Banks

It is expected that the Federal Reserve will cut rates at least once this year, if not twice. On the other hand, interest rates are rising in Japan, and traders are starting to hear people talk about inflation becoming a problem in Japan. That’s probably nonsense, and the Japanese Government Bond market continues to see rising rates that will cause a major problem for the Japanese, and beyond that, we have had several days where there have been no bids in those markets. This is something that we have seen previously, and that always ends up in the same way, the Bank of Japan going in and buying Japanese debt. In other words, quantitative easing. It’s worth noting that even what to interest rate cuts coming out of the Federal Reserve, you would still get paid to hang on to this trade.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.