Short Trade Idea

Enter your short position between $71.53 (yesterday’s intra-day low) and $72.91 (the lower band of its horizontal resistance zone).

Market Index Analysis

- Xcel Energy (XEL) is a member of the NASDAQ 100 and the S&P 500.

- Both indices move away from all-time highs, as bearish pressures dominate.

- The Bull Bear Power Indicator of the S&P 500 turned bearish.

Market Sentiment Analysis

Yesterday’s late-session recovery from the lows received a boost from a favorable antitrust ruling against Google parent Alphabet, which stated it does not have to sell and divest its Chrome browser unit. Countering bullish sentiment is a report suggesting US holiday spending will face the steepest drop since the COVID-19 pandemic. Uncertainty over tariffs persists, and President Trump vowed to keep them intact. Investors are likely to remain cautious until Friday’s NFP report. Futures are mixed, with the Dow Jones down by nearly 200 points, while the NASDAQ is moderately up, with the S&P 500 flat.

Xcel Energy Fundamental Analysis

Xcel Energy is a US-regulated electric utility and natural gas company with four subsidiaries serving Colorado, Minnesota, Wisconsin, Michigan, North Dakota, South Dakota, Texas, and New Mexico. It is also a major player in the green energy transition.

So, why am I bearish on XEL following its breakdown?

Shareholder dilution and value destruction are never bullish signs, and Xcel Energy issued 6.1% more shares over the past year, while its business plan destroys shareholder value. The return on invested capital is dismal, operating margins trail most of its industry peers, and XEL has recently lowered its dividend. Xcel Energy is also facing a probe by the Texas AG into the 2024 Smokehouse Creek and Windy Deuce fires.

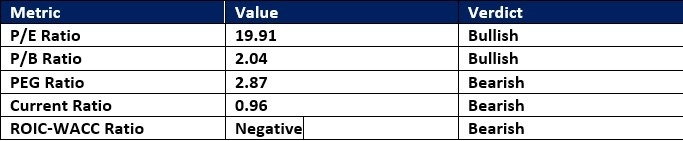

Xcel Energy Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 19.91 indicates that XEL is an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.81.

The average analyst price target for XEL is 77.29, which suggests modest upside potential, while downside pressure is rising.

Xcel Energy Technical Analysis

Xcel Energy Price Chart

- The XEL D1 chart shows a price action breaking down below its horizontal resistance zone.

- It also shows price action breaking down below its ascending 50.0% Fibonacci Retracement Fan level.

- The Bull Bear Power Indicator is bearish with a descending trendline.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- XEL corrected with the S&P 500 but has more bearish factors pressuring price action lower.

Top Regulated Brokers

My Call on Xcel Energy

I am taking a short position in XEL between 71.53 and 72.91. The shareholder dilution and value destruction, the probe by the Texas AG, and the dismal return on invested capital create sufficient bearish catalysts. I will sell the breakdown, as I see more downside ahead.

- XEL Entry Level: Between 71.53 and 72.91

- XEL Take Profit: Between 62.58 and 65.21

- XEL Stop Loss: Between 75.02 and 77.29

- Risk/Reward Ratio: 2.56

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.