Ripple is drifting sideways: support remains intact but upward conviction is lacking.

XRP Momentum Stalls

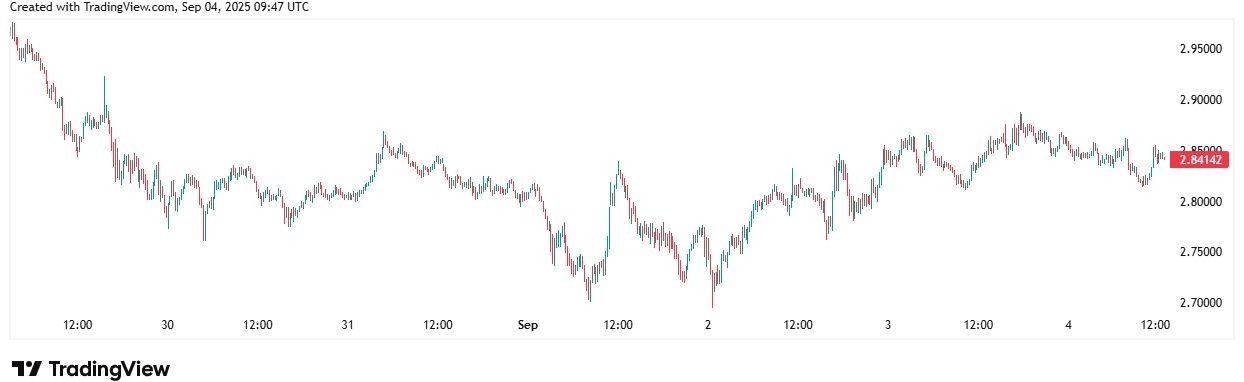

XRP Price Chart | Source: TradingView

XRP has remained within a narrow $2.82 to $2.88 band over the past 24 hours, echoing a broader consolidation that has persisted for weeks. Since early August, XRP has failed to leave the $2.55 to $2.90 corridor, which has frustrated both bullish and bearish setups.

Daily turnover sits between $3 billion and $4.5 billion, indicating steady participation but not enough momentum to spark a breakout.

Bitcoin above $110,853 and Ethereum at $4,389 provide a firm backdrop for altcoins, yet XRP has lagged slightly, highlighting resistance specific to the token.

Resistance Remains a Sticking Point

Every rally toward the $2.90 handle has been met with supply. The key level to watch is $2.91, which has repeatedly rejected upside moves. A strong daily close above would be the first clear sign that bulls are regaining control and could open a run toward $3.20.

Support sits lower at $2.69 and $2.55. These zones absorbed selling earlier in August and remain critical for defending the broader trend.

A slip below $2.55 would change the market tone quickly, with downside targets opening toward $2.40. For now, the chart suggests balance: protect the lows while sellers dominate the highs.

Indicators Show Neutral Momentum with a Slight Bearish Edge

Technical studies back up the stalemate. The Relative Strength Index (RSI) holds near 44, squarely neutral.

There is no evidence of overbought conditions that might justify aggressive selling, nor of oversold readings that would attract bargain hunters.

The MACD leans negative, with its histogram printing red. Momentum tilts toward sellers, though not decisively. Short-term moving averages are flat below the price, reflecting hesitation. Longer-term averages, such as the 100- and 200-day, still sit comfortably beneath current levels and point to a broader uptrend that hasn’t been broken.

Whale Accumulation and Exchange Flows Create a Tug-of-War

Blockchain data adds nuance. Large wallets have been accumulating near the $2.70–$2.80 area, suggesting confidence in XRP’s longer-term trajectory. At the same time, exchange balances are climbing, which usually signals that traders are preparing to sell into strength.

This push and pull often precedes sharp moves once one camp takes control. Sentiment matches the data: long-term holders are patient, but short-term traders remain hesitant without confirmation above the $3 mark.

The split has kept volatility muted, but it also sets the stage for a sudden breakout when the deadlock breaks.

Critical Levels Will Define September’s Direction

The story now hinges on two boundaries. A close above $2.91 with convincing volume would flip the market bullish, opening space for $3.20, then $3.40 and $3.60. Sustained progress beyond those levels could even revive talk of a return to $4.50.

Failure to hold above the lower edge of the current range, especially if price drops under $2.55, would damage sentiment and raise the risk of a slide toward $2.40.

Until one of these lines gives way, traders should expect continued back-and-forth between $2.70 and $2.90.

Final Thoughts

XRP sits in limbo, locked beneath heavy resistance but supported by resilient buyers. Indicators are neutral, whale behavior shows accumulation, and exchange flows suggest readiness to sell. That mix leaves price action grinding sideways with limited conviction.

The next decisive move, either a breakout above $2.91 or a breakdown below $2.55, will set the tone for September.

Until then, XRP remains a waiting game, with traders watching closely for whichever side seizes momentum first.

Ready to trade our technical analyses of Ripple? Here’s our list of the best MT4 crypto brokers worth reviewing.