Long Trade Idea

Enter your long position between $529.01 (a minor horizontal support level) and $546.27 (yesterday’s intra-day high).

Market Index Analysis

- Microsoft (MSFT) is a member of the NASDAQ 100, the Dow Jones Industrial Average, the S&P 100, and the S&P 500 indices.

- All four indices push to fresh highs on the back of the AI bubble, but bearish volumes are rising.

- The Bull Bear Power Indicator of the NASDAQ 100 Index is extremely bullish and suggests upward exhaustion.

Market Sentiment Analysis

The Federal Reserve delivered the expected 25-basis-point interest rate cut, but Fed Chair Powell poured cold water on a guaranteed interest rate cut during its last meeting of 2025 in December. Equity markets gave up earlier gains, except for the NASDAQ 100 Index, where the AI bubble continued to expand. Equity futures are lower this morning after President Trump and President Xi met in South Korea, failing to deliver the bullish catalysts investors had hoped for, as Microsoft and Meta sold off after their earnings reports, but Alphabet countered some of the losses.

Microsoft Fundamental Analysis

Microsoft is the largest software maker, one of the most valuable public companies, and one of the most valuable brands globally. It is a significant player in cloud services, gaming, and AI, following its massive investment in OpenAI.

So, why am I bullish on MSFT despite its post-earnings dip?

Microsoft reported an impressive 26% year-over-year rise in commercial cloud revenue to $49.1 billion, partially offset by the 76% surge in capital expenditures to $34.9 billion. Total revenues came in at $77.7 billion with earnings per share of $3.72 versus estimates of $75.5 billion and $3.68, respectively. I am bullish on the revised deal between Microsoft and OpenAI, which has converted into a for-profit company in which MSFT holds a 27% stake, and on the outlook for its Azure business to expand further, where OpenAI has committed to spending $250 billion.

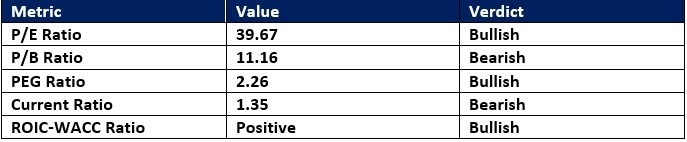

Microsoft Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 39.67 makes MSFT a reasonably priced stock in the AI field. By comparison, the P/E ratio for the NASDAQ 100 is 39.94.

The average analyst price target for MSFT is $620.65. This suggests some excellent upside potential and acceptable downside risk.

Microsoft Technical Analysis

Today’s MSFT Signal

Microsoft Price Chart

- The MSFT D1 chart shows price action inside a bullish price channel.

- It also shows price action challenging the ascending 0.0% Fibonacci Retracement Fan level for a potential breakout.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

- The average bearish trading volumes surged post-earnings, but price action remained tame, adding to bullish conditions.

- MSFT is advancing with the NASDAQ 100, a bullish signal.

Top Regulated Brokers

My Call on Microsoft

I am taking a long position in MSFT between $529.01 and $546.27. I am buying into the potential of Azure and Microsoft’s AI strategy, while its near monopoly on operating systems and the launch of Copilot+ PCs could boost revenues this quarter.

- MSFT Entry Level: Between $529.01 and $546.27

- MSFT Take Profit: Between $600.71 and $620.65

- MSFT Stop Loss: Between $506.00 and $511.97

- Risk/Reward Ratio: 3.12

Ready to trade our free stock signals? Here is our list of the best stock brokers worth checking out.