Long Trade Idea

Enter your long position between $334.17 (the intra-day low before its most recent breakout) and $350.98 (yesterday’s intra-day high).

Market Index Analysis

- The Visa (V) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500 indices.

- All three indices push to fresh highs on the back of the AI bubble, but bearish volumes are rising.

- The Bull Bear Power Indicator of the S&P 500 is extremely bullish and suggests upward exhaustion.

Market Sentiment Analysis

The Federal Reserve delivered the expected 25-basis-point interest rate cut, but Fed Chair Powell poured cold water on a guaranteed interest rate cut during its last meeting of 2025 in December. Equity markets gave up earlier gains, except for the NASDAQ 100 Index, where the AI bubble continued to expand. Equity futures are lower this morning after President Trump and President Xi met in South Korea, failing to deliver the bullish catalysts investors had hoped for, as Microsoft and Meta sold off after their earnings reports, but Alphabet countered some of the losses.

Visa Fundamental Analysis

Visa is one of the world’s top three payment card service providers and the largest outside China. It facilitates electronic funds transfers globally.

So, why am I bullish on V after its earnings beat?

The latest earnings showed net revenue of $10.2 billion, beating estimates and rising 14% year on year. Its payment volumes rose a healthy 8%, while Visa Direct transactions surged 25%, and value-added service was up 26%. Earnings per share of $2.98 beat estimates by a penny, but I am bullish on Visa for its AI adoption and push into stablecoins, where its market share rises, setting up V for future revenue growth.

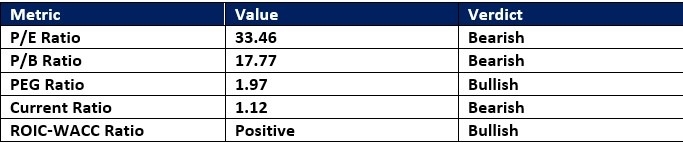

Visa Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 33.46 makes V an expensive stock. By comparison, the P/E ratio for the S&P 500 Index is 30.97.

The average analyst price target for V is $394.78, suggesting good upside potential, with manageable downside risk.

Visa Technical Analysis

Today’s V Signal

Visa Price Chart

- The V D1 chart shows a price action bouncing off its horizontal support zone.

- It also shows price action breaking out above its descending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator crossed over into bearish conditions but remains above its ascending trendline.

- The average bearish trading volumes surged post-earnings, but price action remained in bullish conditions.

- V corrected as the S&P 500 Index recorded fresh highs, a bearish trading signal, but bullish signals have emerged.

Top Regulated Brokers

My Call on Visa

I am taking a long position in V between $334.17 and $350.98. V has excellent operational metrics, and its double-digit earnings-per-share growth should continue as its presence in stablecoins grows, supported by rising transaction volumes in its core business.

- V Entry Level: Between $334.17 and $350.98

- V Take Profit: Between $375.51 and $394.78

- V Stop Loss: Between $316.65 and $322.18

- Risk/Reward Ratio: 2.36

Ready to trade our free stock signals? Here is our list of the best stock brokers worth checking out.