Long Trade Idea

Enter your long position between 115.39 (the lower band of its horizontal support zone) and 119.82 (the upper band of its horizontal support zone).

Market Index Analysis

- Airbnb (ABNB) is a member of the NASDAQ 100 and the S&P 500

- Both indices trade within bearish chart patterns and rising bearish trading volumes

- The Bull Bear Power Indicator of the NASDAQ 100 is in bearish territory with a descending trendline

Market Sentiment Analysis

Equity futures are in the red after the AI-related sell-off continues. NVIDIA will report earnings after the bell today, and analysts expect a move of up to 7% in either direction, or roughly $320 billion. Adding to economic worries is the downbeat consumer outlook from Home Depot yesterday, while preliminary government data on continuing jobless claims showed the labor market in worse conditions than feared. Markets will receive earnings from Target, Lowe’s, and TJX Companies before the bell, which will provide further insight into consumer health.

Airbnb Fundamental Analysis

Airbnb is the best-known online marketplace and broker for short-term rentals and long-term homestays. Despite its permanent ban on parties and events, the company continues to face stiff opposition to its properties in core markets. Still, it has announced plans to become an Everything App powered by AI.

So, why am I bullish on ABNB after its earnings release?

Revenues of $4.10 billion beat estimates of $4.08, while earnings per share of $2.21 missed expectations of $2.34. However, Airbnb reported a 9% surge in nights and seats booked year over year, bringing the total to 133.6 million. Regulatory scrutiny and changing travel trends pose risks. Still, I remain bullish on its drive to become an everything app powered by AI, with rising profit margins, and on holiday-season travel this year.

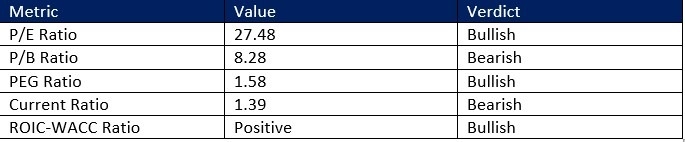

Airbnb Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 27.48 makes ABNB a reasonably priced stock. By comparison, the P/E ratio for the NASDAQ 100 is 36.06.

The average analyst price target for ABNB is 139.25. It suggests strong upside potential with reduced downside risk.

Airbnb Technical Analysis

- Today’s ABNB Signal

The ABNB D1 chart shows price action inside its horizontal support zone

The ABNB D1 chart shows price action inside its horizontal support zone - It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels

- The Bull Bear Power Indicator is bearish, but within range of its ascending trendline

- The average bearish trading volumes are higher than the average bullish ones, but hint at bearish exhaustion

- ABNB corrected with the NASDAQ 100, but bullish catalysts continue to accumulate

My Call

I am taking a long position in ABNB between 115.39 and 119.82. I am buying the excellent operational statistics and the plan to invest up to $250 million to transform its app into a lifestyle app. It should more than offset the negative impacts of the changing regulatory and travel landscape.

Top Regulated Brokers

- ABNB Entry Level: Between 115.39 and 119.82

- ABNB Take Profit: Between 139.25 and 143.30

- ABNB Stop Loss: Between 106.30 and 109.79

- Risk/Reward Ratio: 2.63

Ready to trade our analysis of Airbnb? Here is our list of the best stock brokers worth checking out.

The ABNB D1 chart shows price action inside its horizontal support zone

The ABNB D1 chart shows price action inside its horizontal support zone