Long Trade Idea

Enter your long position between $331.71 (the intra-day low of its last bearish candlestick) and $345.84 (its most recent intra-day high).

Market Index Analysis

- Amgen (AMGN) is a member of the NASDAQ 100, the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

- All four indices resume their recovery but are climbing the same wall of worry as before the sell-off.

- The Bull Bear Power Indicator of the NASDAQ 100 Index turned bullish but features a descending trendline.

Market Sentiment Analysis

Equity markets rallied for a fourth session following last week’s sell-off to finish the holiday-shortened trading session higher. Investors piled into AI stocks and reversed their opinion on another 25 basis points of interest rate cut. With consumer confidence low, investors will pay attention to Black Friday to gauge activity. It is no longer a one-time sales event of the past, but it still provides valuable insights into consumer behavior. Markets ignore claims of circular financing against NVIDIA, and the AI bubble discussion continues to attract opinions on both sides.

Top Regulated Brokers

Amgen Fundamental Analysis

Amgen is the 18th largest biomedical company by revenue, a Fortune 500 company, and has 17 clinical programs in Phase III, 8 in Phase II, and 19 in Phase I.

So, why am I bullish on AMGN despite its recent 28%+ rally?

The recent full FDA approval of IMDELLTRA (tarlatamab-dlle) follows a stellar third-quarter earnings report in which 16 products delivered double-digit growth. AMGN is a free cash flow machine, generating $4.2 billion in the third quarter. I remain bullish on its deep pipeline of life-saving medicines, the pending approval of its gastric cancer drug, and its industry-leading return on equity.

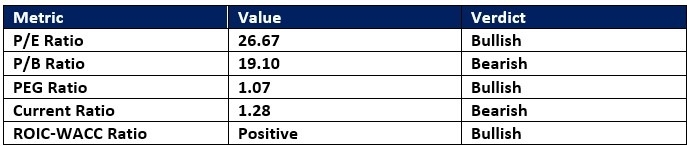

Amgen Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 26.67 makes AMGN fairly valued. By comparison, the P/E ratio for the NASDAQ 100 Index is 33.89.

The average analyst price target for AMGN is $313.48. It suggests no upside, but revisions are likely due to its current pipeline.

Amgen Technical Analysis

Today’s AMGN Signal

Amgen Price Chart

- The AMGN D1 chart shows price action inside a bullish price channel.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

- The average bullish trading volumes are higher than the average bearish trading volumes.

- AMGN accelerated more than the NASDAQ 100 Index, a significant bullish sign.

My Call on Amgen

I am taking a long position in AMGN between $331.71 and $345.84. The full FDA approval of IMDELLTRA, the pending approval for its gastric cancer drug, and 16 products delivering double-digit growth should power AMGN higher from current levels.

- AMGN Entry Level: Between $331.71 and $345.84

- AMGN Take Profit: Between $371.78 and $381.07

- AMGN Stop Loss: Between $312.52 and $288.36

- Risk/Reward Ratio: 2.09

Ready to trade our analysis of Amgen? Here is our list of the best stock brokers worth checking out.