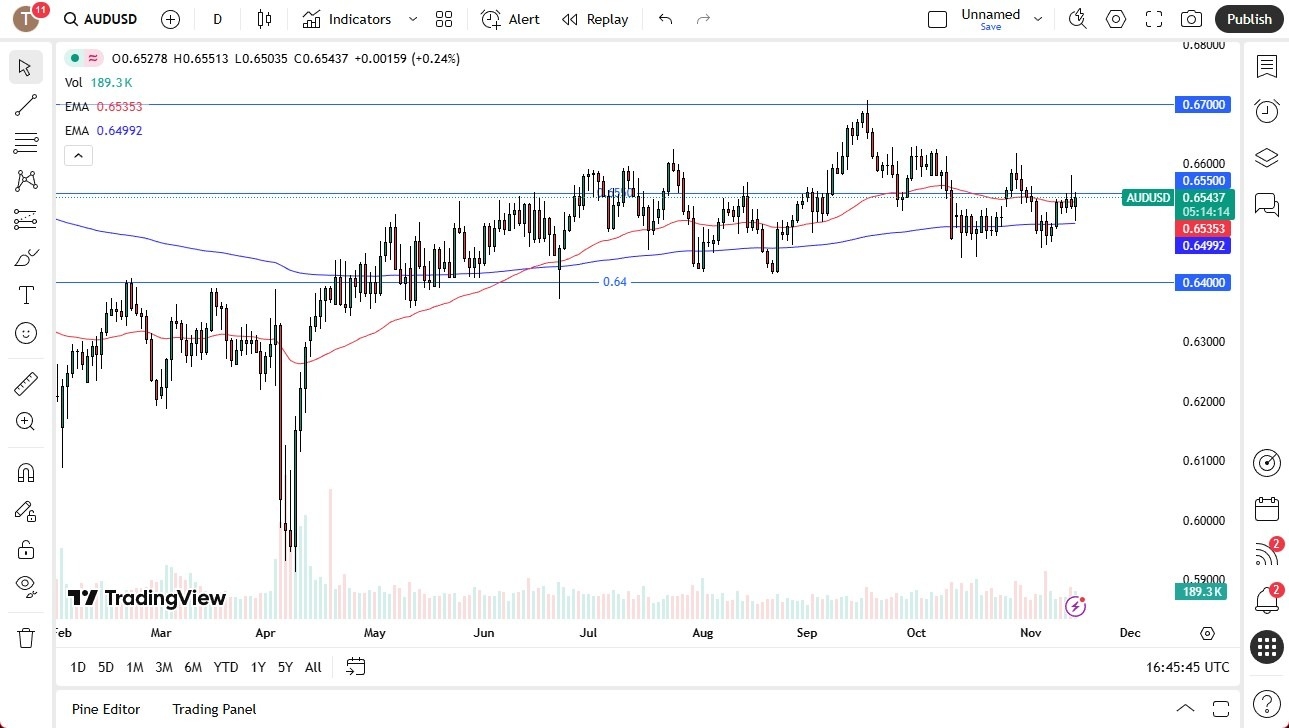

- The Australian dollar initially dipped but regained strength near the 200-day EMA, with price gravitating toward 0.6550.

- Traders are watching resistance at 0.66 and broader risk appetite as China, the U.S., and commodities continue to drive AUD behavior.

The Australian dollar fell initially during the trading session on Friday, only to turn around and see signs of life. The 200-day EMA offered a bit of support as it typically at least attracts some attention. And now we find ourselves hanging around the 0.6550 level, a magnet for price, and a break above that level that then opens up the possibility of a move to the 0.66 level.

Top Regulated Brokers

The 0.66 level is an area that I do believe would be short-term resistance. I do anticipate that we will see a lot of noisy behavior. And at this juncture, I think you've got a situation where the Australian dollar is still looking for some type of momentum. The lack of momentum means that we are not going to continue to see a lot of questions asked about risk appetite, as the Australian economy itself is heavily influenced by commodities and Asian growth.

Trump and Xi

With this being the case, I think you will have to continue to watch the United States and China as far as the way things are going between those two economies, as it will have a direct influence on exports of hard materials out of Australia.

Ultimately, if you're a short-term trader, you probably look at this as a potential back-and-forth type of short-term range-bounding trade. This range-bound trade is likely to continue to be something that short-term traders will be attracted to, but longer-term traders are simply looking at the Australian dollar and wanting to know when things finally return to some type of trend other than the trend of going sideways.

Ready to trade our AUD/USD Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.