Gold is an excellent portfolio hedge due to its low correlation with equities. It also offers protection against inflation, stability during uncertain times, and a psychological wealth effect. The inverse relationship to the US Dollar adds to its appeal as a diversification asset.

What are Gold Stocks?

Gold stocks are publicly listed companies active in the Gold sector. They are primarily involved in the exploration, extraction, and refining of Gold. The recent adoption of AI has opened the path for service companies that use AI to discover deposits. Gold storage companies offer an alternative to direct Gold exposure. Still, investors should focus on exploration, extraction, and refining of Gold via established and junior Gold miners.

Why Should You Consider Investing in Gold Stocks?

Gold has always fascinated as a wealth and status symbol, but Gold stocks offer numerous benefits, and investors should consider adding them to their portfolios. Some analysts see Gold as offering downside protection for equity portfolios and as a hedge against inflation, tending to perform well during periods of US Dollar weakness.

Here are a few things to consider when evaluating Gold stocks:

- Invest in a combination of established Gold miners for stability and dividends, and junior miners, which carry greater risks but can offer good upside potential.

- Analyze Gold reserves of Gold miners to gauge the longevity of their operations.

- Focus 75% of your portfolio on Gold stocks with mining operations in the top ten countries for Gold production, with the remaining 25% on exciting global projects.

What are the Downsides of Gold Stocks?

Volatile Gold prices pose the most notable risk, as they directly impact the profitability of Gold stocks. While the last three years have witnessed high Gold prices and all-time highs, which encouraged exploration and higher dividend yields, other periods have seen depressed prices. Long-term, Gold is likely to march higher as the current global economic and political landscape faces graver risks than at any point in the past 70 years.

Here is a shortlist of attractive Gold stocks for 2026:

- B2Gold (BTG)

- Fortuna Mining (FSM)

- IAMGOLD Corporation (IAG)

- Equinox Gold (EQX)

- Hycroft Mining (HYMC)

Update on our Previous Best Gold Stocks to Buy Now

In our previous installment, I highlighted the upside potential of Newmont Corporation and Franco-Nevada Corporation.

Newmont Corporation (NEM) - A long position in NEM between $89.20 and $93.98

NEM has rallied nearly 15%, and I keep my long position, but I have set my stop-loss at 102.00 for a minimum profit of nearly 11%.

Franco-Nevada Corporation (FNV) - A long position in FNV between $202.77 and $208.86

FNV is up roughly 3% since I took my long position, and I will keep holding it, as I see more upside potential.

B2Gold Fundamental Analysis

B2Gold (BTG) owns and operates Gold mines in Mali, Namibia, and the Philippines. Some of its most prominent mergers include Central Sun Mining, CGA Mining, Auryx Gold, and Papillon Resources. It is also a member of the S&P/TSX Composite.

So, why am I bullish on BTG at current levels?

B2Gold ranks among the Gold miners with the highest Gold-price leverage. Gold prices may wel accelerate further in 2026, and BTG features an impressive earnings-per-share growth rate of over 70%. I am bullish on the prospects of its Goose Mine, despite its lower-than-expected guidance in its latest earnings report, which is expected to add 4,000 tons of daily production. It also has a low consolidated all-in sustaining costs (AISC) of $1,479 per Gold ounce.

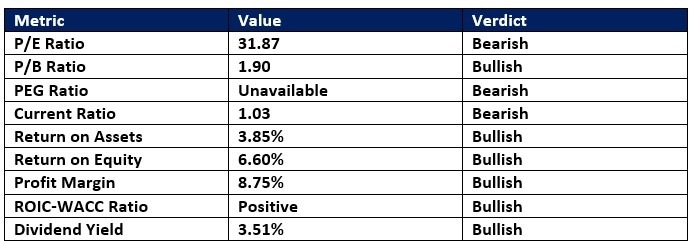

B2Gold Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 31.87 makes BTG an expensive stock. By comparison, the P/E ratio for the S&P 500 is 31.28.

The average analyst price target for BTG is $5.66. This suggests an excellent upside potential with reasonable downside risks.

B2Gold Technical Analysis

B2Gold Price Chart

- The BTG D1 chart shows price action just below its ascending Fibonacci Retracement Fan.

- It also shows B2Gold advancing inside a bullish price channel.

- The Bull Bear Power Indicator is bullish, but shows a negative divergence, suggesting potential short-term volatility ahead.

My Call on B2Gold

I am taking a long position in BTG between $4.63 and $4.83. I am bullish about its low AISC, its low forward P/E ratio of 5.29, and the undervalued prospects of its Goose Mine.

- BTG Entry Level: Between $4.63 and $4.83

- BTG Take Profit: Between $5.66 and $5.94

- BTG Stop Loss: Between $4.15 and $4.35

- Risk/Reward Ratio: 2.15

Fortuna Mining Fundamental Analysis

Fortuna Mining (FSM) has operations and exploration activities in Argentina, Côte d’Ivoire, Mexico, Peru, and Senegal. It primarily extracts Gold and silver with by-products lead and zinc. It is also a member of the S&P/TSX Composite.

So, why am I bullish on Fortuna Mining near its 52-week high?

Fortuna Mining has industry-leading returns on assets and equity, as well as superb profit margins. It also has a relatively low consolidated all-in sustaining cost (AISC) of $1,718 per Gold ounce. Despite its 100%+ rally in 2025, valuations remain low, and I am bullish about its well-diversified growth pipeline. I also like its cash positions and divestiture of non-producing and underperforming mines.

Fortuna Mining Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 12.05 makes FSM an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 31.28.

The average analyst price target for Fortuna Mining is $11.00. It suggests fair upside potential with manageable downside risks.

Fortuna Mining Technical Analysis

Fortuna Mining Price Chart

- The FSM D1 chart shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- It also shows Fortuna Mining inside a bullish price channel.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

My Call on Fortuna Mining

I am taking a long position in Fortuna Mining between $9.85 and $10.38. I am bullish about its low valuations, 5-year PEG ratio, and diversified growth pipeline.

- FSM Entry Level: Between $9.85 and $10.38

- FSM Take Profit: Between $11.32 and $11.66

- FSM Stop Loss: Between $9.17 and $9.39

- Risk/Reward Ratio: 2.16

Ready to trade our analysis of the best Gold stocks? Here is our list of the best stock brokers worth reviewing.