Bitcoin has crashed to its lowest level since May, as the US government's reopening after a 43-day shutdown failed to lift investor sentiments. With the market sentiment in “extreme fear” and liquidations soaring, the market now braces for a deeper correction.

Bitcoin Price Drops to Lowest Level Since May

On Sunday, the BTC/USD pair dipped to $92,955, its weakest since May 1, down 13.5% from $107,465 on Nov.11. The plunge came even as US president Donald Trump signed a spending bill to end the longest government shutdown in the history of the United States, amplifying risk-off sentiment in the market.

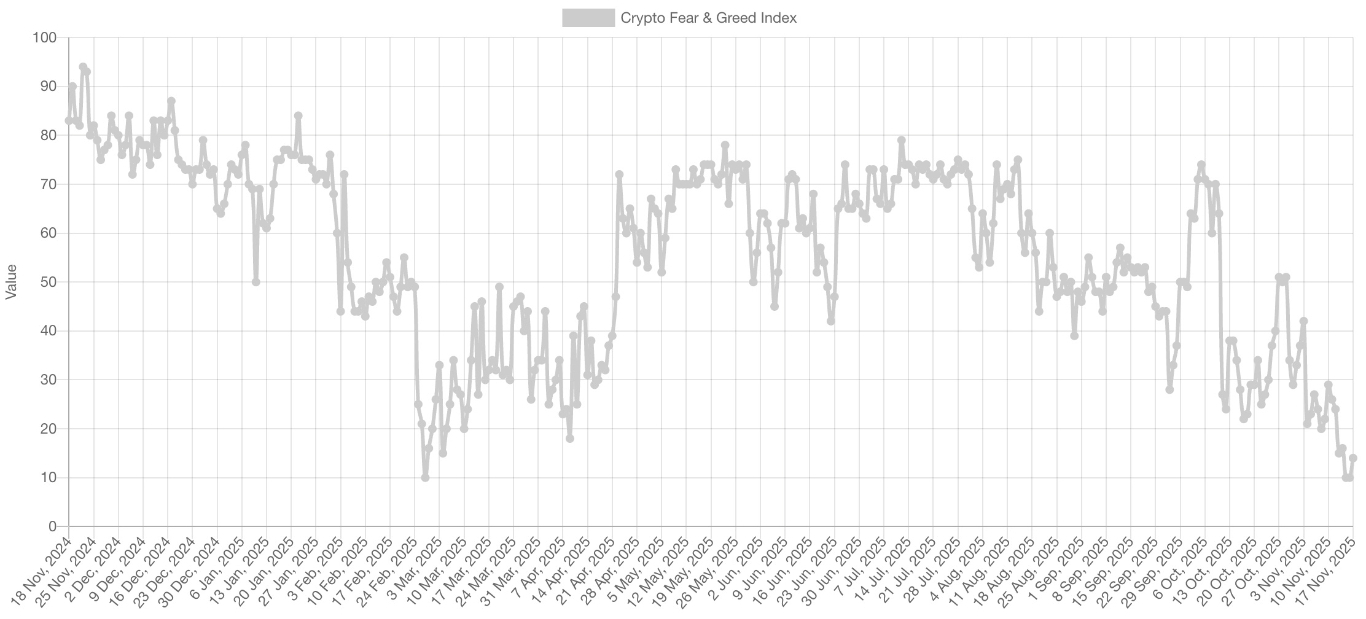

Market sentiment cratered into "extreme fear," with the Crypto Fear & Greed Index dropping as low as 10—the lowest since February 2025. This blends volatility, volume, social media mentions, and analyst comments, reflecting investor panic.

Crypto fear and greed index. Source: Alternative.me

The sell-off triggered $1.13 billion in long BTC liquidations between November 11–16, per data from CoinGlass, with $532 million on November 15. Over 93% hit bullish positions on Bybit and Hyperliquid as prices broke below $100,000 and $96,000.

Year-to-date gains shrank to 2.45%, as at the time of writing on Monday, pressuring bulls. BTC tests $92,000–$94,000 near miner breakevens, with $1.88 billion daily volume but no inflows. If this continues, Bitcoin’s could extend its downtrend toward the lower-$80,000s.

End of US Government Shutdown Failed to Lift Sentiment

The reapopening on the US government on November 13, after a 43-day shutdown, promised liquidity for risk assets like Bitcoin. Instead, the BTC/USD pair slid further as ETF outflows surged and treasury buying stalled, revealing institutional caution.

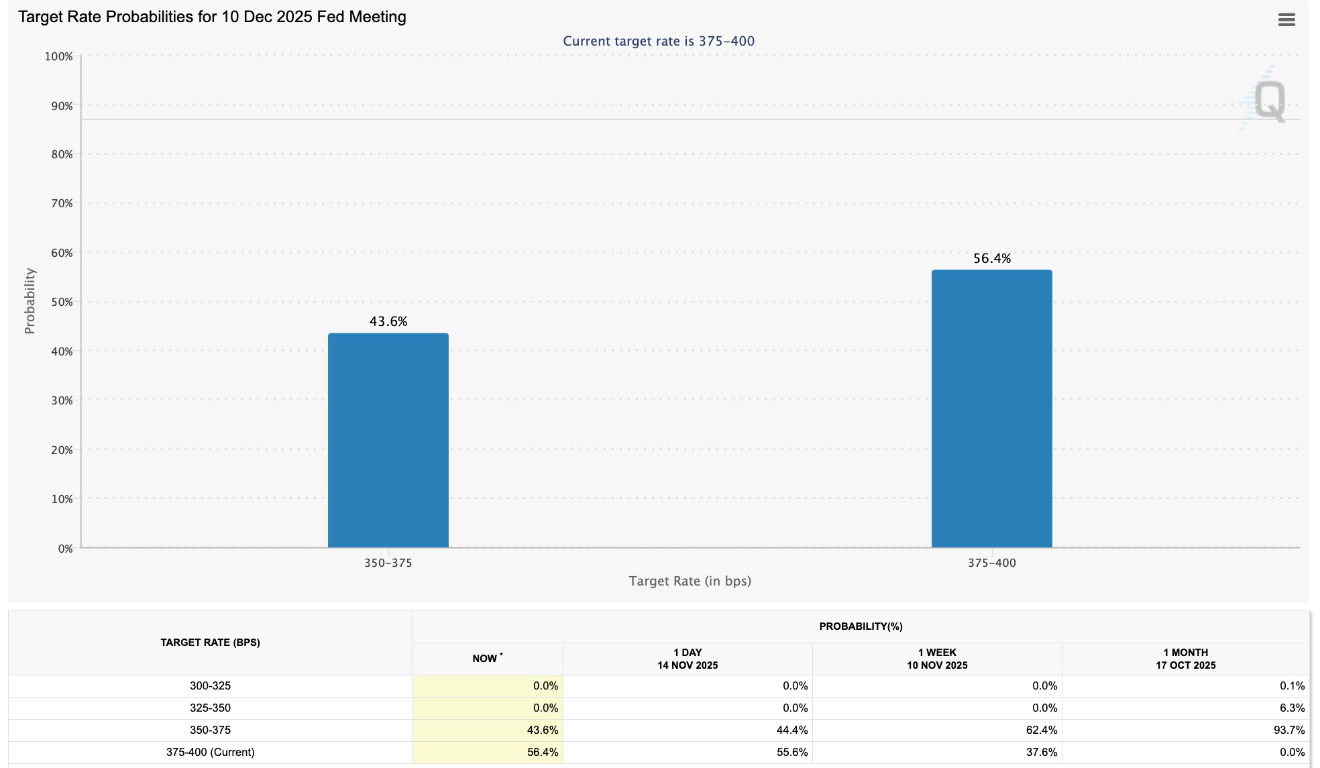

The bill injected billions into the economy, market participants have now halved the odds of Fed rate cuts in December to 43.6% down from 62.4% last week and 93.7% a month ago, according to the CME group Fedwatch tool.

Target rates for Dec. 10 FOMC meeting. Source: Fedwatch tool

Bitcoin Magazine called BTC a liquidity "canary," noting the shutdown drained funds with no unwind relief, adding to the uncertainty in the market.

Spot Bitcoin ETFs, which have been key to BTC adoption in 2025, have lost $3.1 billion since early November, recording net outflows in seven out of the 10 trading days so far this month.

November 13 saw $870 million outflows—the second-worst since their debut on January 11 2024—with Grayscale's GBTC down $318 million and BlackRock's IBIT $257 million.

Spot Bitcoin ETF flows table. Source: SoSoValue

Treasury buying slowed sharply. Corporate appetite for Bitcoin cooled in October, even as total holdings across companies, governments, and ETFs reached their highest level on record, a sign the sector is shifting from rapid accumulation to a more defensive stance across balance sheets.

This has crushed sentiment and unless there is fresh demand from institutional investors, retail and day traders, the downside outlook will remain.

Bitcoin Bear Flag Breakdown Targets $83,000

From a technical perspective, BTC price formation has broken below a bear flag, as shown in the chart below. The measured move from the flagpole (107,500 - $92,000) points to $83,600 as the next major target. This level coincides with the 100-week simple moving average.

The first line of resistance is the yearly open around $93,300, which bulls must defend to protect the 2025 uptrend. Lower than that, the $92,000 level and the psychological level at 90,000 are the other support areas to watch on the downside.

BTC/USD four-hour chart. Source: TradingView/Cointelegraph

The RSI has dropped to 34 from 45 on November 11, suggesting increasing downward momentum.

Negative funding rates and spiking put open interest below $90,000 increase the odds of a cascade if selling resumes. While some contrarians see extreme fear as a contrarian buy, the weight of ETF outflows, LTH distribution, and macro headwinds currently favors bears. Until BTC reclaims $98,700, the path of least resistance remains downward.

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.