My previous BTC/USD signal on 3rd November was not triggered.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades must be entered before 5pm Tokyo time Tuesday.

Long Trade Ideas

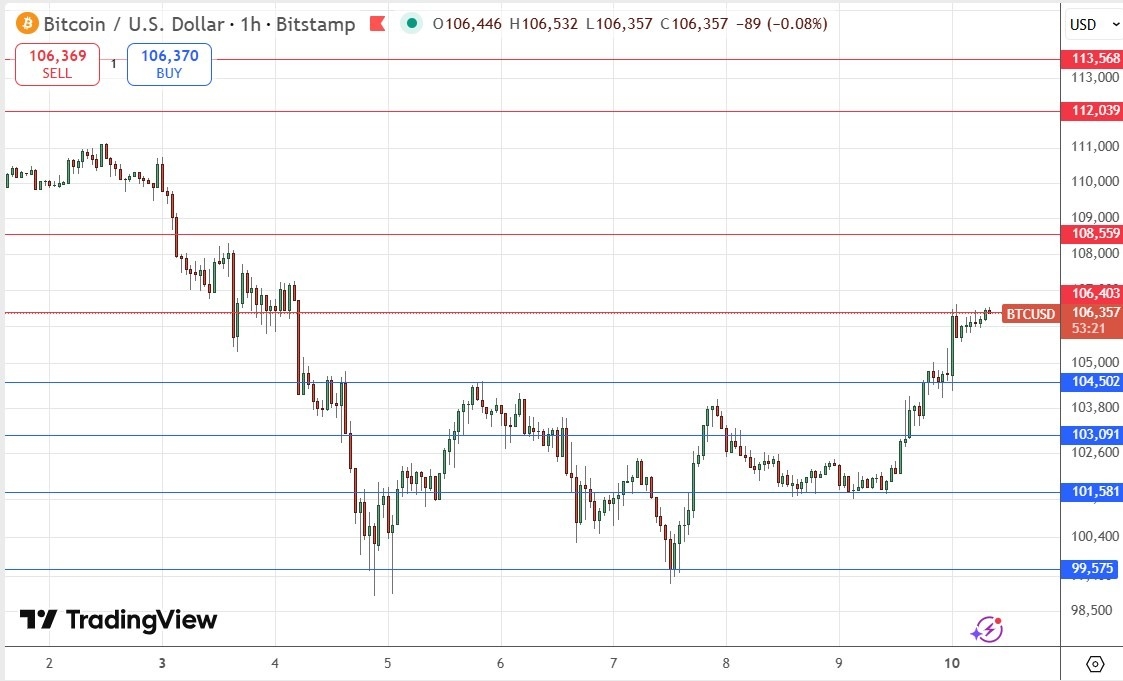

- Go long after a bullish price action reversal on the H1 timeframe following the next touch of $104,502, $103,091, or $112,039.

- Put the stop loss $100 below the local swing low.

- Move the stop loss to break even once the trade is $100 in profit by price.

- Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Go short after a bullish price action reversal on the H1 timeframe following the next touch of $106,403, $108,559, or $113,568.

- Put the stop loss $100 above the local swing high.

- Move the stop loss to break even once the trade is $100 in profit by price.

- Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

Top Regulated Brokers

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

In my last BTC/USD forecast exactly one week ago, I thought that we were likely to see the completion of a bearish head and shoulders chart pattern, with the neckline/day’s pivotal point at the support level of $106,155. This was a good call, as although there was an initial bounce from a breakdown under that level, it was very quick, so by applying my usual method of waiting for a couple of hours, it would have got you into a profitable short trade during the following Asian session.

Now, one week later, the technical picture is very different. We saw the price dip below $100k for the first time in months late last week on deteriorating risk sentiment and a selloff throughout the cryptocurrency sector. However, the sips below $100,000 picked up strong buying, and the price has been rising firmly since Friday, making a notable bullish breakout beyond $104,502.

The price action remains bullish, and we look likely to make another bullish breakout, beyond the resistance level at $106,403.

The bullish case is strengthened by a broad rise in risk-on sentiment, driven by several factors: a likely end to the US government shutdown, Trump’s floating of a tariff dividend check for Americans (except high earners), and China’s resumption of rare earths exports to the US which will help the tech sector. These factors are also sending Bitcoin higher.

I think the best approach today will be to follow the momentum and enter a new long trade following two consecutive hourly closes above $106,403, if the candlesticks have no significant upper wicks.

There is nothing of high importance due today regarding either Bitcoin or the US Dollar.

Ready to trade our daily Forex signals? Here is our list of the best MT4 crypto brokers worth reviewing.