Short Trade Idea

Enter your short position between $253.84 (yesterday’s intra-day low) and $266.62 (yesterday’s intra-day high).

Market Index Analysis

- Coinbase (COIN) is a member of the S&P 500 Index.

- This index resumes its recovery but is climbing the same wall of worry as before the sell-off.

- The Bull Bear Power Indicator of the S&P 500 turned bullish but features a descending trendline.

Market Sentiment Analysis

Equity markets rallied for a fourth session following last week’s sell-off to finish the holiday-shortened trading session higher. Investors piled into AI stocks and reversed their opinion on another 25 basis points of interest rate cut. With consumer confidence low, investors will pay attention to Black Friday to gauge activity. It is no longer a one-time sales event of the past, but it still provides valuable insights into consumer behavior. Markets ignore claims of circular financing against NVIDIA, and the AI bubble discussion continues to attract opinions on both sides.

Coinbase Fundamental Analysis

Coinbase is the world’s biggest Bitcoin custodian and the largest US-based cryptocurrency exchange with over 100 million users. It operates in over 100 countries, holds over $400 billion in assets, including over 12% of Bitcoins and over 11% of all staked Ether.

So, why am I bearish on COIN despite its 48%+ correction?

While Coinbase remains the dominant exchange for US-based customers, the $3 billion acquisition of derivatives exchange Deribit added transaction volume. I remain bearish because it trails Binance across the board, and new competitors are entering the space. The 5-year PEG ratio indicates the company remains significantly overvalued at current levels, and while I like the move to an “everything exchange,” it will take a few quarters to materialize.

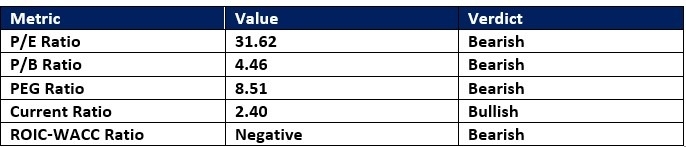

Coinbase Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 31.62 makes COIN an expensive stock. By comparison, the P/E ratio for the S&P 500 Index is 30.63.

The average analyst price target for COIN is $383.94. This suggests massive upside potential, but downside risks remain elevated.

Coinbase Technical Analysis

Today’s COIN Signal

Coinbase Price Chart

- The COIN D1 chart shows price action inside a bearish price channel.

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with a descending trendline.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- COIN corrected as the S&P 500 Index rallied, a significant bearish development.

Top Regulated Brokers

My Call on Coinbase

I am taking a short position in COIN between $253.84 and $266.62. Valuations have decreased amid the nearly 50% sell-off, but they remain excessive. I appreciate its international acquisitions, but the overall portfolio trails industry-leader Binance, and I see more downside amid growing competition.

- COIN Entry Level: Between $253.84 and $266.62

- COIN Take Profit: Between $142.58 and $163.52

- COIN Stop Loss: Between $292.76 and $303.96

- Risk/Reward Ratio: 2.86

Ready to trade our analysis of Amgen? Here is our list of the best stock brokers worth checking out.