Long Trade Idea

Enter your long position between 54.11 (the lower band of its support resistance zone) and 60.36 (the upper band of its horizontal support zone).

Market Index Analysis

- DexCom (DXCM) is a member of the NASDAQ 100 and the S&P 500.

- Both indices try to hold on to records, but bearish catalysts are accumulating.

- The Bull Bear Power Indicator of the S&P 500 is bearish with a descending trendline.

Market Sentiment Analysis

Equity futures are rising following a volatile week, which saw new worries about the AI bubble, partially fueled by concerns over creative accounting rules for depreciation of massive infrastructure investments and by revenue concerns. Despite the end of the government shutdown, economic data may trail for a while. Still, investors await NVIDIA’s earnings on Wednesday, which will move markets. Other notable earnings reports, this week, include Walmart, Home Depot, Target, Lowe’s, and Gap, which will offer insight into consumer spending.

DexCom Fundamental Analysis

DexCom is a leader in continuous glucose monitoring (CGM). Its G7 device is the most accurate CGM approved in the US, and DexCom is at the core of the MAHA (Make America Healthy Again) movement.

So, why am I bullish on DXCM after its earnings report?

Top Regulated Brokers

Total revenues surged 21.6% to $1.21 billion, with earnings per share of $0.61, both higher than expected, and DexCom raised its full-year outlook. Still, shares plunged almost 15% following the report amid concerns about the shifting regulatory landscape and increased competition. I remain bullish on the ongoing advancements in glucose monitoring technology, its recent partnership announcements, and rising profit margins.

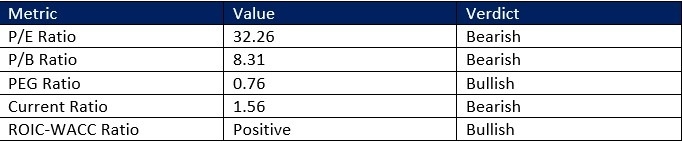

The price-to-earnings (P/E) ratio of 32.26 makes DXCM an expensive stock. By comparison, the P/E ratio for the S&P 500 is 30.26.

The average analyst price target for DXCM is 84.96. It suggests excellent upside potential with manageable downside risks.

DexCom Technical Analysis

Today’s DXCM Signal

- The DXCM D1 chart shows a price action inside its horizontal support zone.

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels

- The Bull Bear Power Indicator is bearish with a positive divergence

- The average bullish trading volumes are higher than the average bearish trading volumes

- DXCM corrected as the S&P 500 hovers near records, a bearish confirmation, but bullish momentum is rising

My Call

I am taking a long position in DXCM between 54.11 and 60.36. The returns on assets, equity, and invested capital rank among the best in its sector. Profit margins are excellent and improving, and the PEG ratio suggests further upside.

- DXCM Entry Level: Between 54.11 and 60.36

- DXCM Take Profit: Between 66.42 and 72.08

- DXCM Stop Loss: Between 49.86 and 51.41

- Risk/Reward Ratio: 2.90

Ready to trade our analysis of DexCom? Here is our list of the best stock brokers worth checking out.