EUR/USD Analysis Summary Today

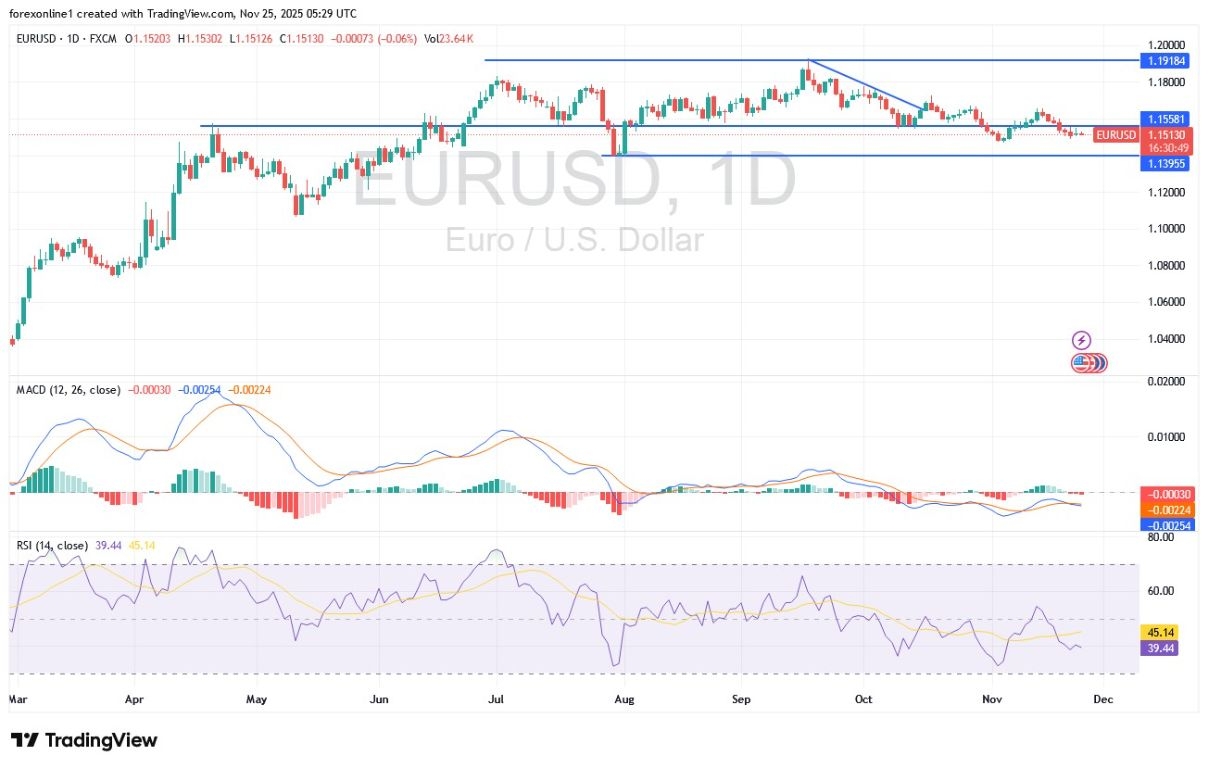

- Overall Trend: : Bearish.

- Support Levels for EUR/USD Today: 1.1480 – 1.1420 – 1.1340.

- Resistance Levels for EUR/USD Today: 1.1600 – 1.1660 – 1.1780.

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1460 with a target of 1.1700 and a stop-loss at 1.1380.

- Sell EUR/USD from the resistance level of 1.1660 with a target of 1.1400 and a stop-loss at 1.1780.

Technical Analysis of EUR/USD Today:

As anticipated, the EUR/USD trading will remain in narrow ranges until the market reacts to the US economic releases that were held back due to the longest government shutdown in US history. Across trusted trading company platforms, the Euro/Dollar price has remained within the range of 1.1500 and 1.1550, awaiting any new developments.

According to the technical analysis of the currency pair, the US dollar shows few signs of weakening. Forex market data shows the US dollar has been steadily rising against the euro since September, and this sharp decline is expected to continue in the coming days. Looking at the charts, we see that the EUR/USD pair fell below the 21-day exponential moving average (EMA) at 1.1593 last week. It needed to hold above this level to solidify its early November rebound into a more sustained rally.

In short, the early November rally has faded, and the short-term technical framework favors further weakness, making a test of the November 5 low of 1.1468 likely. The 14-day Relative Strength Index (RSI) is around a reading of 40, confirming the bears' control. At the same time, the MACD indicator is clearly leaning downwards.

Top Regulated Brokers

The EUR/USD bullish scenario, as seen on the daily chart, remains contingent on a return to the 1.1800 resistance level. The currency market will be awaiting the release of German GDP figures at 9:00 AM Egypt time, followed by key US economic releases: US retail sales figures and the Producer Price Index (PPI), a key measure of inflation, at 3:30 PM Egypt time.

US Dollar Performance Under the Influence of Future Monetary Policy

According to recent performance across licensed trading company platforms, the rise in the US Dollar price comes as the market gradually scales back expectations for a US interest rate cut by the Federal Reserve in December 2025, due to strong economic data and persistent US inflation. With the market still anticipating an approximately 50% probability of a rate cut, there is ample room for prices to continue moving counter to the December sentiment. If the US Dollar is encouraged to do so this week, the Euro/Dollar trading will remain under pressure.

The US Dollar price will be affected by price movement this week. Follow the Producer Price Index (PPI) data today (Tuesday)—an inflation gauge for US manufacturers—for more indications on the evolution of the inflationary situation in the United States. The US PPI is important because it indicates the future of the core inflation rate. It is expected to register 0.3%, and any reading lower than that would negatively affect the US Dollar and ensure continued support for the EUR/USD pair until mid-week.

Trading Tips:

Keep in mind that the Euro/Dollar moving in narrow ranges is often followed by a strong move in one direction or the other, so monitor the results of the US economic releases and their impact on currency prices closely.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.