EUR/USD Analysis Summary Today

- Overall Trend: : Neutral.

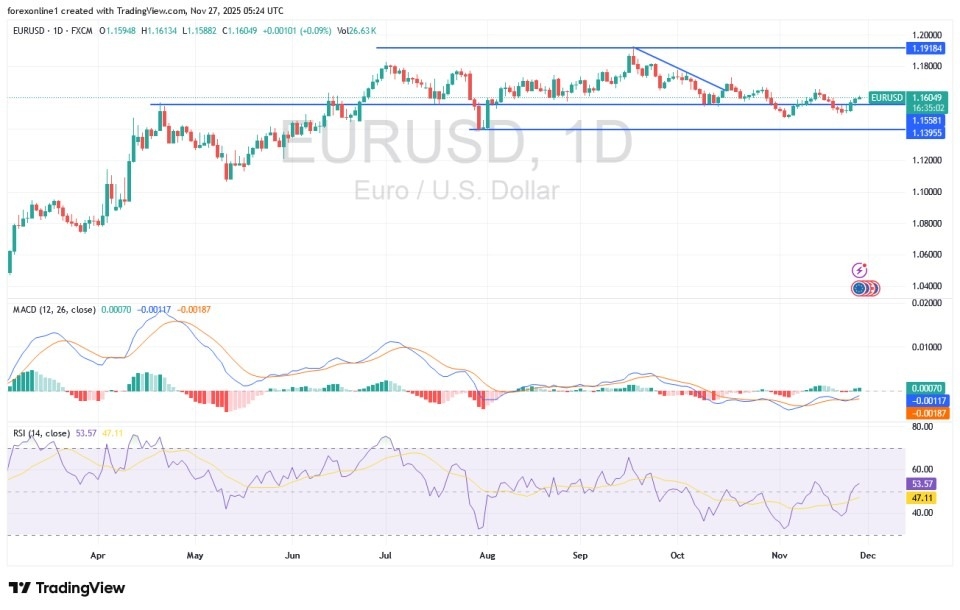

- Support Levels for EUR/USD Today: 1.1565 – 1.1480 – 1.1400

- Resistance Levels for EUR/USD Today: 1.1660 – 1.1720 – 1.1800

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1520 with a target of 1.1700 and a stop-loss at 1.1450.

- Sell EUR/USD from the resistance level of 1.1720 with a target of 1.1500 and a stop-loss at 1.1800.

Technical Analysis of EUR/USD Today:

Ahead of today's US holiday, liquidity and investor appetite for new trades may weaken. This has enabled the EUR/USD pair to rebound, reaching the resistance level of 1.1615 and currently holding steady around its gains at the time of writing. On reputable trading platforms, the EUR/USD pair has been attempting to recover from the losses of the recent downward reversal, which pushed it towards the support level of 1.1491, the lowest point for the currency pair in three weeks. Today, the euro is up 0.20% against the dollar, marking its third consecutive session of gains. Over the past three sessions, the euro has risen 0.70%. Since the beginning of November, it has gained 0.49% against the dollar. And since the beginning of 2025, the euro has risen 11.96% against the US dollar.

Top Regulated Brokers

The Upward Reversal for the Euro/Dollar is Still Early

Based on trading on the daily chart, the recent gains in the EUR/USD have not amounted to a shift in the overall trend to bullish but rather a return to the neutral zone. Confirming this is the stability of the 14-day Relative Strength Index (RSI) around a reading of 53 (above the neutral line of 50), and the MACD indicator lines are starting to turn upwards. To confirm a bullish reversal in the currency pair's trend, a push towards the resistance levels of 1.1720 and 1.1800 sequentially is necessary.

Conversely, over the same timeframe, the EUR/USD trajectory will return to bearish if the bears succeed in pushing the pair back towards the support levels of 1.1520 and 1.1440 sequentially. It should be taken into account that with the US holiday, there are no significant European economic releases, which confirms that the Euro/Dollar price will be influenced by the reaction to the latest US economic data announcements and investor sentiment towards risk-taking.

Trading Advice:

Keep in mind that the upward reversal for the Euro/Dollar is just beginning. Wait for stronger positive stimulus factors and stronger gains to firmly confirm the upward shift.

Eurozone Bond Yields Under Pressure

Based on recent trading, Eurozone government bond yields fell slightly after the weaker-than-expected German IFO Business Climate Survey showed, maintaining concerns about the economy's fragility. As recently announced, the IFO Business Climate Index fell to 88.1 in November, below expectations in a Wall Street Journal survey for a slight rise to 88.5. The probability of a US interest rate cut also increased after New York Fed President John Williams stated on Friday that another near-term US interest rate cut might be warranted. However, the yield declines remain limited as equity prices rise.

Finally, tradeweb data showed that the yield on Germany's 10-year Bund fell by 1.2 basis points to 2.682%.

Ready to trade our Forex daily analysis and predictions? Here's a list of regulated forex brokers to choose from.