- The Nasdaq 100 saw a sharp, unexpected selloff on Thursday, but the price remains within a broader uptrend near 25,000 and the 50-day EMA.

- Despite recent volatility, key support levels suggest traders may soon look for a buying opportunity.

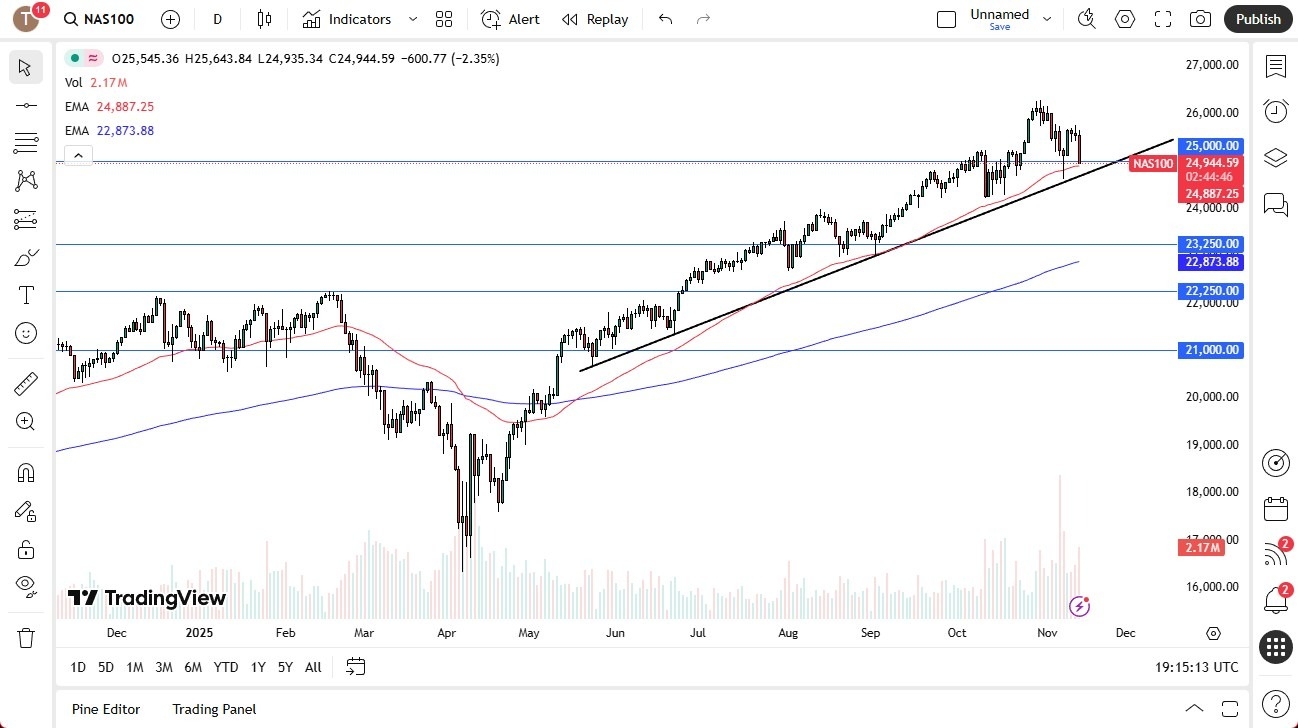

It's been a bloodbath in the Nasdaq 100 during the trading session as everybody simultaneously decided to panic on Thursday. This is one of those weird drops that nobody really sees coming. The US government reopened. There's a bunch of data that's going to be released now that hasn’t been released previously, so maybe that's it. It really doesn't matter because at the end of the day, we are still very much in an uptrend.

25,000 Again

Top Regulated Brokers

It is worth noting that the 25,000 level is right around where we are hanging out. Furthermore, you also have the 50-day EMA in the same neighborhood. So, I do think you have a scenario where traders are going to be looking at this through the lens of a buy on the dip situation. We'll just have to wait and see. We don't see the bounce yet, but ultimately, this is a market that I do think is going to find a lot of support in the round figure of 25,000, as well as the 50-day EMA and the uptrend line.

So all things being equal, what I expect to see is maybe a short-term drop from here, perhaps. And then at that point in time, we'll be looking at a potential bounce. Now, once we get that bounce, you've got the very real possibility of being a buyer again, because we are in an uptrend. Now, with that being said, if we were to drop down below the 24,600 level, then it's likely that we would see a significant drop down to the 24,000 level.

I don't think that happens, but we'll just have to wait and see. We've had a couple of these ugly red candlesticks as of late, but the market does continue to show a bit of resiliency here, as we had seen about five trading sessions ago last week, when we plunged below the 50-day EMA only to turn back around. As things stand right now, I expect to see that happen again.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.