Long Trade Idea

Enter your long position between $498.00 (the intra-day low before its breakout) and $521.87 (the closing high of its breakout).

Market Index Analysis

- Ulta Beauty (ULTA) is a member of the S&P 500 Index.

- This index retreated from record highs, and a bearish price channel is forming.

- The Bull Bear Power Indicator of the S&P 500 turned bearish with a descending trendline.

Market Sentiment Analysis

Equity futures point to a bullish start following Friday’s mid-session reversal, with beaten-down AI names leading the way. Hopes for an end to the longest shutdown in US history add to bullish sentiment. Consumer sentiment dropped to a three-year low, and markets await the release of core inflation reports that the government did not publish. Investors will receive more crucial earnings reports this week, led by CoreWeave, Oklo, Rocket Lab, The Walt Disney Company, and Paramount Skydance, but should brace for volatility ahead.

Ulta Beauty Fundamental Analysis

Ulta Beauty is a cosmetics retailer offering high-end brands and mass-market products. It sells makeup, fragrances, skincare, and haircare products, and each location has a beauty salon.

So, why am I bullish on ULTA following its correction?

Ulta Beauty continues to expand internationally, and I am bullish on its Middle East expansion with its first store in Kuwait. It introduces new products to the region, and ULTA faces no competition there. ULTA has excellent operational metrics, including an average return on invested capital nearly three times the industry average. Ulta Beauty is also a free cash flow machine, which supports further growth.

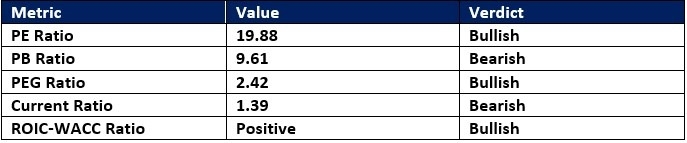

Ulta Beauty Fundamental Analysis Snapshot

The price-to-earning (PE) ratio of 19.88 makes ULTA an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is $30.24.

The average analyst price target for ULTA is $575.78. It suggests a strong upside potential with reduced downside risk.

Ulta Beauty Technical Analysis

Today’s ULTA Signal

Ulta Beauty Price Chart

- The ULTA D1 chart shows price action breaking out above its horizontal support zone.

- It also shows price action below its ascending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator is bearish with a positive divergence, approaching a bullish crossover.

- The average bullish trading volumes are higher than the average bearish trading volumes since the breakout.

- ULTA corrected as the S&P 500 Index slid from all-time highs, a bearish development, but bullish catalysts have accumulated.

My Call on Ulta Beauty

I am taking a long position in ULTA between $498.00 and $521.87. The free cash flow supports international expansion plans, and operational metrics are excellent. I expect an upbeat earning report next month, driven by its growth initiatives and new partnerships.

- ULTA Entry Level: Between $498.00 and $521.87

- ULTA Take Profit: Between $572.23 and $589.40

- ULTA Stop Loss: Between $461.99 and $471.51

- Risk/Reward Ratio: 2.06

Top Regulated Brokers

Ready to trade our analysis of Ulta Beauty? Here’s our list of the best MT4 crypto brokers worth reviewing.