Short Trade Idea

Enter your short position between $106.27 (the intra-day high of its last bearish candlestick) and $108.15 (the previous time price action reached the upper band of its bearish price channel).

Market Index Analysis

- Walmart (WMT) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

- All three are recovering from massive AI-led selloffs, but bearish factors dominate.

- The Bull Bear Power Indicator of the S&P 500 Index turned bearish but shows a descending trendline.

Market Sentiment Analysis

Equity markets look poised to extend their rally, led by the AI rebound. Markets ignore the slump in consumer confidence and focus on renewed hopes for a December interest rate cut. Also, retail sales came in well below expectations, confirming a slowing consumer, and retailers flagged pressures on low and middle-income households. Valuations remain stretched, and no developments materialized to change the valuation or AI-bubble narrative this week. The third quarter earnings season is slowly winding down, as over 95% of S&P 500 companies have reported earnings.

Walmart Fundamental Analysis

Walmart is one of the largest companies by revenue globally, the largest private employer, and the largest publicly traded family-owned company. It has over 10,000 stores operating over 45 names in 24 countries.

So, why am I bearish on WMT after its earnings report?

Walmart reported third-quarter revenues of $179.50 billion with earnings per share of $0.62, beating expectations of $177.43 billion and $0.60, respectively. It raised the top-end of its full-year outlook by $0.01, but I remain bearish on WMT due to rising input costs, reliance on discounts during the holiday shopping season, and a weakened consumer. Delayed government data showed dismal September retail sales and cratering consumer confidence.

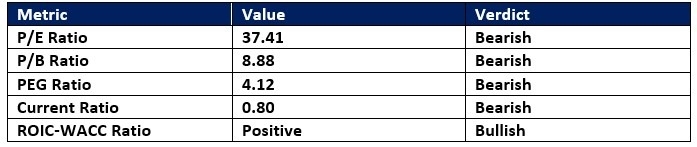

Walmart Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 37.41 makes WMT an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.85.

The average analyst price target for WMT is $118.38. It suggests moderate upside potential, while downside risks remain magnified.

Walmart Technical Analysis

Today’s WMT Signal

Walmart Price Chart

- The WMT D1 chart shows price action inside a bearish price channel.

- It also shows price action trading between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish with a descending trendline.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- WMT advanced with the S&P 500, a bullish confirmation, but bearish catalysts have risen.

Top Regulated Brokers

My Call on Walmart

I am taking a short position in WMT between $106.27 and $108.15. Excessive valuation, stagnant margins, rising input costs, and a weakening consumer sentiment, all concern me in the medium term. I also see stiff competition from other retailers during the crucial holiday shopping season that could pressure razor-thin margins.

- WMT Entry Level: Between $106.27 and $108.15

- WMT Take Profit: Between $91.89 and $93.43

- WMT Stop Loss: Between $112.86 and $115.13

- Risk/Reward Ratio: 2.18

Ready to trade our analysis of Walmart? Here is our list of the best stock brokers worth reviewing.