The strong recent rally in Zcash has captured global attention amid rising demands for onchain privacy.

ZEC Flips XMR and SHIB in Market Capitalization

Top Regulated Brokers

Zcash's meteoric rise over the past three months was marked by relentless upward momentum that has reshaped its market standing.

At the beginning of September, the privacy coin was forgotten and trading at $33, more than 99% below its $5,941.80 all-time high reached in 2026, according to data from CoinMarketCap.

By mid-September, subtle volume spikes hinted at brewing interest, with ZEC price creeping to $50 as onchain activity in shielded transactions—Zcash's core privacy feature—began to stir.

The Zcash price then skyrocketed after renowned investor Naval Ravikant called it an “insurance against Bitcoin” in a post on Oct. 1. It jumped by more than 60% on the day and has continued its upside momentum ever since.

The ZEC/USD pair rallied 684% in October alone, before rising a further 10% to hit an eight-year high of $445 on Saturday, Nov. 1.

The asset’s crowning glory came last week, when ZEC’s market cap flipped both Monero (XMR) and Shiba Inu (SHIB), cementing its dominance in the privacy sector.

At $6.96 billion—up from $800 million in August—ZEC eclipsed XMR’s $6.1 billion and SHIB’s $5.67 billion, vaulting from rank 84 to 21 on the CoinMarketCap ranking.

The rally ignited renewed investor appetite for other privacy-focused coins, with Dash (DASH) and Beldex (BDX) rising by 250% and 38%, respectively, over the same period.

Privacy coins such as Zcash and Monero obscure sender, receiver and transaction details, offering greater anonymity than pseudonymous cryptocurrencies like Bitcoin (BTC). While Bitcoin transactions are traceable onchain, privacy tokens are designed to mask wallet addresses and transaction histories.

What is Behind the Zcash Rally?

Zcash’s rally can be attributed to a potent mix of tech upgrades, institutional backing, and macro privacy demand. The Zashi CrossPay upgrade in early October unlocked seamless crosschain transfers to Solana and Ethereum, spiking shielded transactions 7X and locking 30% of supply in privacy pools. This solved liquidity isolation, fueling DeFi experiments with untraceable swaps via NEAR Intents.

Institutional demand also surged, with Grayscale’s Zcash Trust hitting $137 million in assets under management, up 228% in October.

Spot ZEC ETF rumors also emerged, positioning Zcash as a compliant hedge against CBDC surveillance and EU AMLR rules.

High-profile endorsements have supercharged ZEC’s bullish narrative, with BitMEX co-founder Arthur Hayes calling ZEC “semi-quantum ready” and Bitcoin’s privacy rival, sparking a 30% intraday surge and flipped sentiment. Naval Ravikant labeled it “insurance against Bitcoin.”

Macro tailwinds amplified the fire: rising global data scrutiny (GENIUS Act, Fed volatility) drove privacy coin cap to $22 billion. Zcash’s optional transparency beat Monero’s rigidity, avoiding delistings. ECC’s Q4 roadmap—Zebra nodes, Zcash Shielded Assets, and a looming PoS shift—plus November’s halving (cutting rewards 50%)—tightened supply, adding to the tailwinds.

How High Can the ZEC Price Go?

As November unfolds, Zcash stands at a pivotal crossroads, with technicals screaming bullish continuation but flashing caution on overextension.

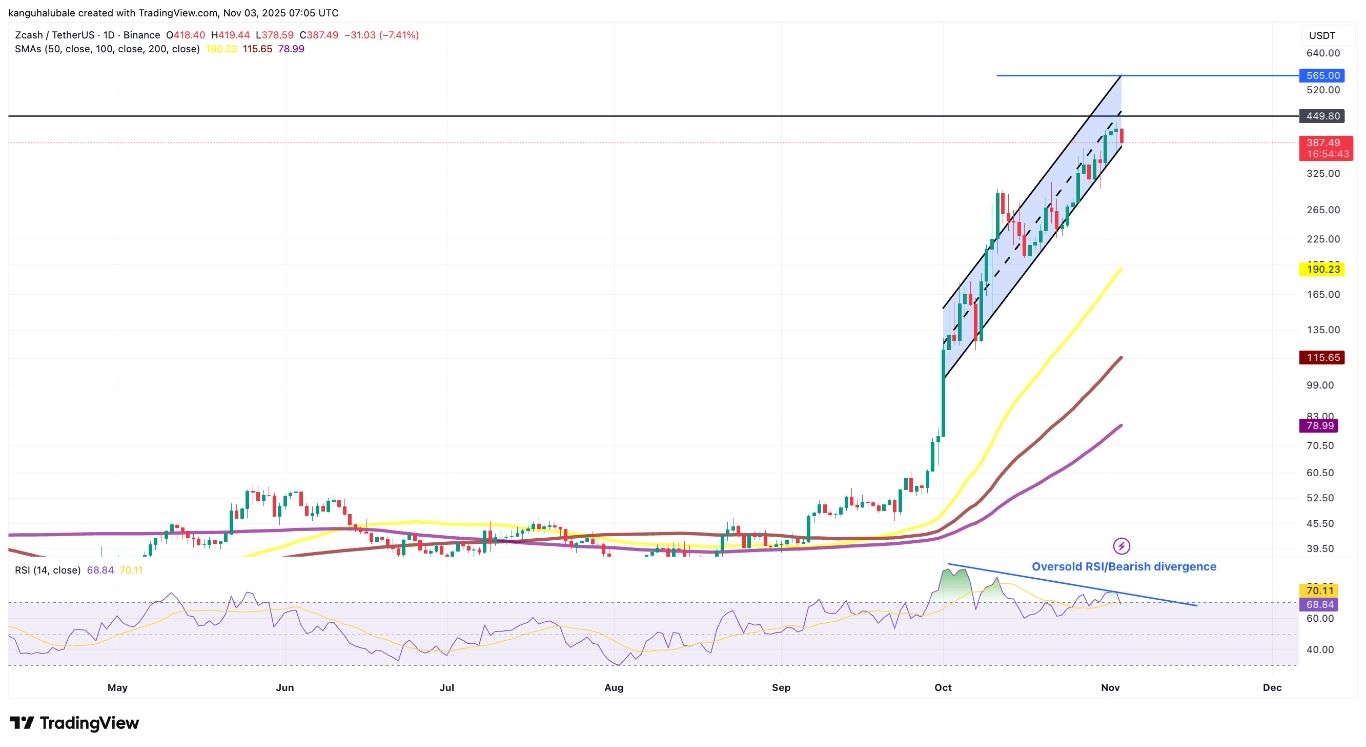

Trading at $385, ZEC has formed an ascending channel in the daily time frame since the $115 October low, with a V-shaped recovery confirming the break of the eight-year downtrend at $350. The bullish target of the ascending channel is its upper boundary at $565.

All the major moving averages are trailing the price, a reliable long-term bullish signal backed by strong volumes.

Fibonacci extensions from the 2020-2021 cycle project $940 as the next leg if $415 resistance holds, representing a 43% upside from the current price.

Fibonacci extensions from the 2020-2021 cycle project $940 as the next leg if $415 resistance holds, representing a 43% upside from the current price.

Meanwhile, the RSI is oversold on multiple timeframes, with the bearish divergence in the daily time frame suggesting decreasing upward momentum as buyer exhaustion sets in. Such conditions usually precede short-term price corrections.

However, analysts remain bullish on ZEC’s ability to move higher, with Mert Mumtaz, co-founder and CEO of Helius, a Solana-focused development company, publicly floating a $1,000 target for Zcash.

Most recently, BitMEX co-founder Arthur Hayes stoked the ZEC uptrend with a $10,000 call, leading to a 30% rise in ZEC’s price.

Ready to trade our analysis of Zcash? Here’s our list of the best MT4 crypto brokers worth checking out.